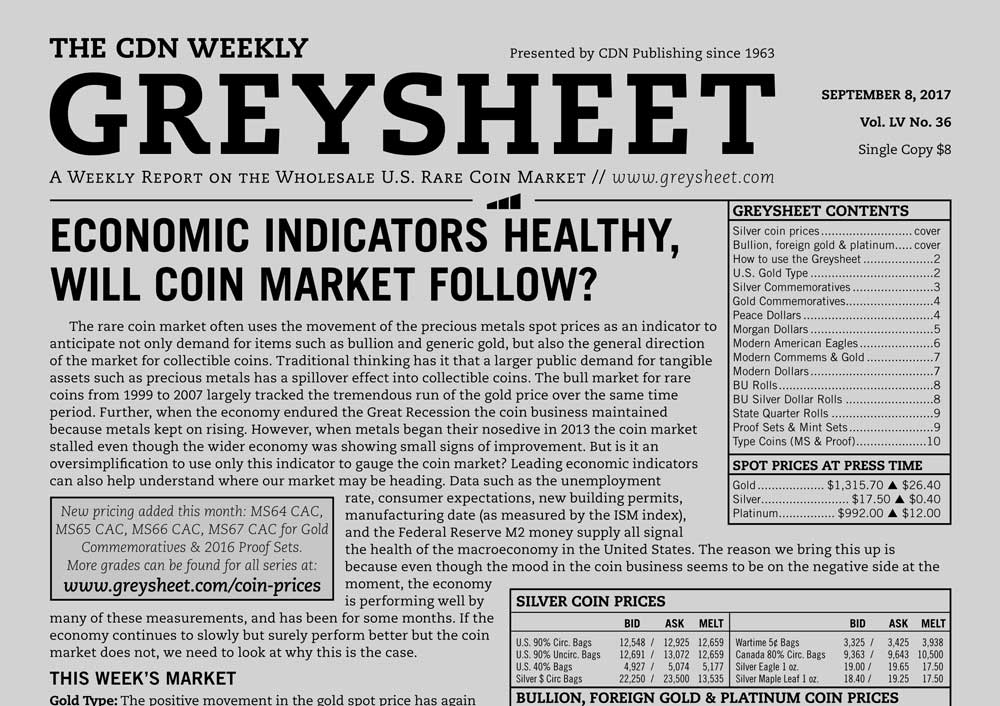

GREYSHEET: ECONOMIC INDICATORS HEALTHY, WILL COIN MARKET FOLLOW?

The rare coin market often uses the movement of the precious metals spot prices as an indicator to anticipate not only demand for items such as bullion and generic gold, but also the general direction of the market for collectible coins. Traditional thinking has it that a larger public demand for tangible assets such as precious metals has a spillover effect into collectible coins. The bull market for rare coins from 1999 to 2007 largely tracked the tremendous run of the gold price over the same time period. Further, when the economy endured the Great Recession the coin business maintained because metals kept on rising. However, when metals began their nosedive in 2013 the coin market stalled even though the wider economy was showing small signs of improvement. But is it an oversimplification to use only this indicator to gauge the coin market? Leading economic indicators can also help understand where our market may be heading. Data such as the unemployment rate, consumer expectations, new building permits, manufacturing date (as measured by the ISM index), and the Federal Reserve M2 money supply all signal the health of the macroeconomy in the United States. The reason we bring this up is because even though the mood in the coin business seems to be on the negative side at the moment, the economy is performing well by many of these measurements, and has been for some months. If the economy continues to slowly but surely perform better but the coin market does not, we need to look at why this is the case.

THIS WEEK’S MARKET

Gold Type:

The positive movement in the gold spot price has again increased bidding activity for generic gold coins. In the recent past we have seen that as the gold price increased, premiums have decreased. However, we have not seen that this time. The only tightening seen this week is for Gem Saints.

Gold Commemoratives:

This series continues to suffer due primarily to a lack of demand and surplus supply. While the $50 slugs have held solid over the past year and a half, all of the other coins in the series continue to find new lows at auction.

Morgan Dollars:

We begin this week another comprehensive review of this active and volatile series. Most of the activity is centered on the MS65 and MS66 grades, where realized prices continue to be all over the proverbial map within the same certified grade.

Peace Dollars:

We have updated pricing for common date circulated coins as we have observed wholesale trades that were below our previous levels. We consulted with traders in this material to find the appropriate levels.

New pricing added this month: MS64 CAC, MS65 CAC, MS66 CAC, MS67 CAC for Gold Commemoratives & 2016 Proof Sets. More grades can be found for all series at: www.greysheet.com/coin-prices”

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to Monthly Greysheet for the industry's most respected pricing and to read more articles just like this.

Source: CDN Publishing