A Letter from Mark Salzberg

The collectibles markets have not merely survived the COVID-19 crisis — they have thrived. The early indicators of strength and stability, including extraordinary demand for bullion and impressive auction results, proved accurate. Prices and participation have risen rapidly since the beginning of the pandemic.

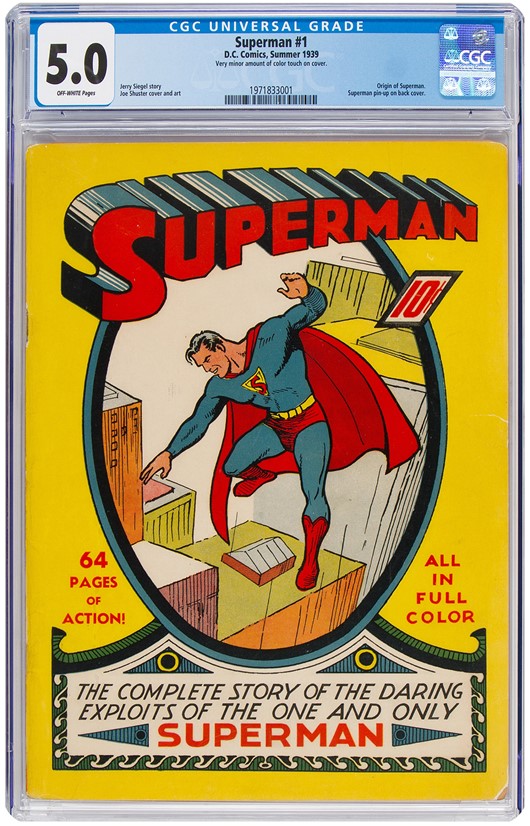

Last month, Heritage Auctions sold this Superman #1 (DC, 1939) graded CGC 5.0 for $360,000

SARASOTA, Fla. (September 24, 2020) — My Friends and Colleagues in the Collectibles Community: We have now lived more than half a year amid a global pandemic that has changed the way we interact with each other, do business and think about the future. At the outset, I encouraged dealers to quickly adapt to this new era in which collectibles are transacted almost exclusively online, often sight-unseen. In my more than 40 years in collectibles and business, I have seen that there is opportunity in crisis for those who can embrace change and react swiftly. If ever there was a time to be bold and innovative, this was it.

Today, I am elated to say that the collectibles markets have not merely survived the COVID-19 crisis — they have thrived. The early indicators of strength and stability, including extraordinary demand for bullion and impressive auction results, proved accurate. Prices and participation have risen rapidly since the beginning of the pandemic.

For years, I have said that collectibles are an emerging asset class. Now, there is no doubt: collectibles are an asset class. A broad range of collectibles, including coins, banknotes, comic books and trading cards, have become highly liquid and fungible. There is even fractional ownership of collectibles.

Why are the collectibles markets so vibrant?

I believe that as much as the pandemic acted as a reset button for our society, it also served as a gas pedal, accelerating a change in priorities that would have been a much longer time coming.

The internet has made collectibles accessible to everyone, and third-party certification has made buying collectibles far safer and more transparent. NGC, PMG, CGC, ASG and CAG give buyers everywhere in the world confidence that collectibles are genuine, accurately graded, properly described, securely protected by state-of-the-art holders and backed by comprehensive guarantees.

With greater accessibility, safety and confidence comes increased and broad-based interest. This interest has brought massive numbers of collectors, dealers and investors into the collectibles markets, transforming our industry almost overnight in the midst of a global crisis.

Collectibles now regularly make headlines in the Wall Street Journal, the New York Times, Forbes and other storied publications. People talk about collectibles alongside stocks, bonds and other traditional investments, but there is a key difference: they love their collections.

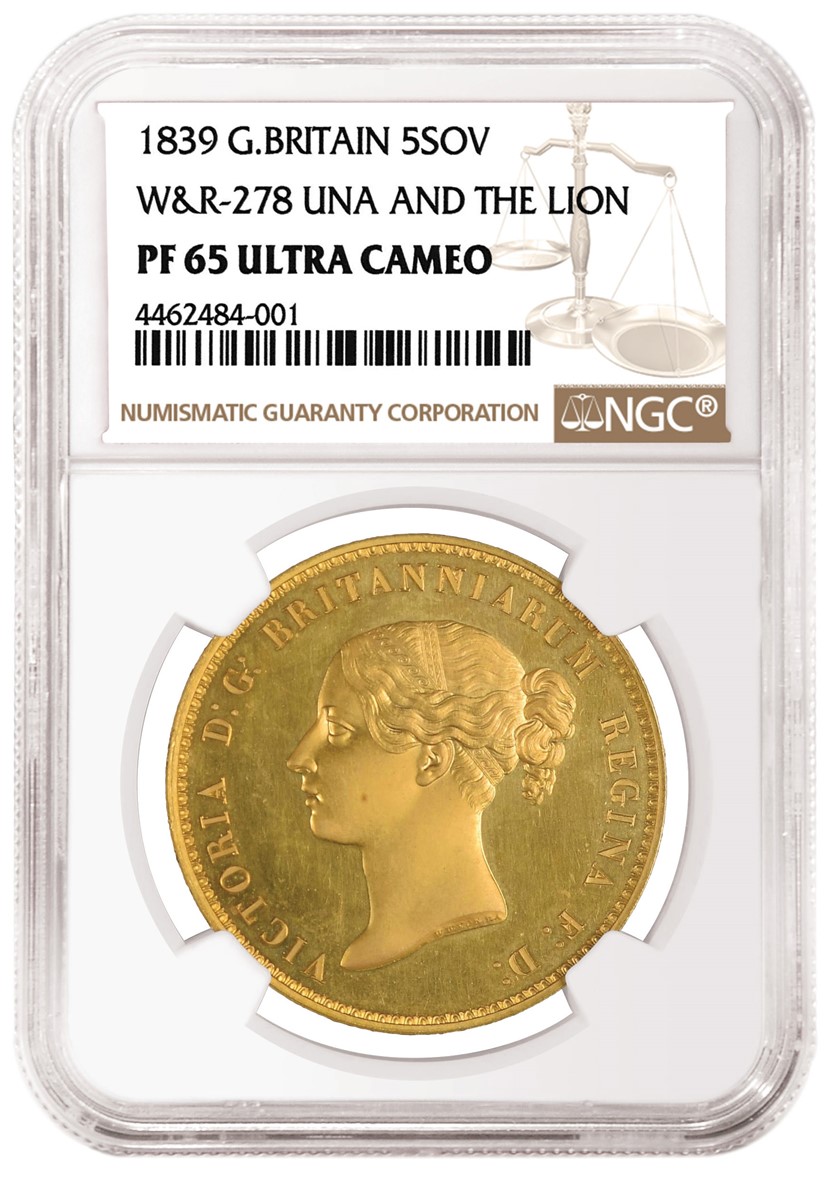

This 1839 Victoria Gold “Una and the Lion” Five Pounds graded NGC PF 65 Ultra Cameo realized over $900,000 in a recent Japan auction, double the price paid less than three years earlier.

Here are just a few of the collectibles that have made news during the pandemic:

An 1839 Victoria Gold “Una and the Lion” Five Pounds graded NGC PF 65 Ultra Cameo realized over $900,000 in a recent Japan auction, double the price paid less than three years earlier.

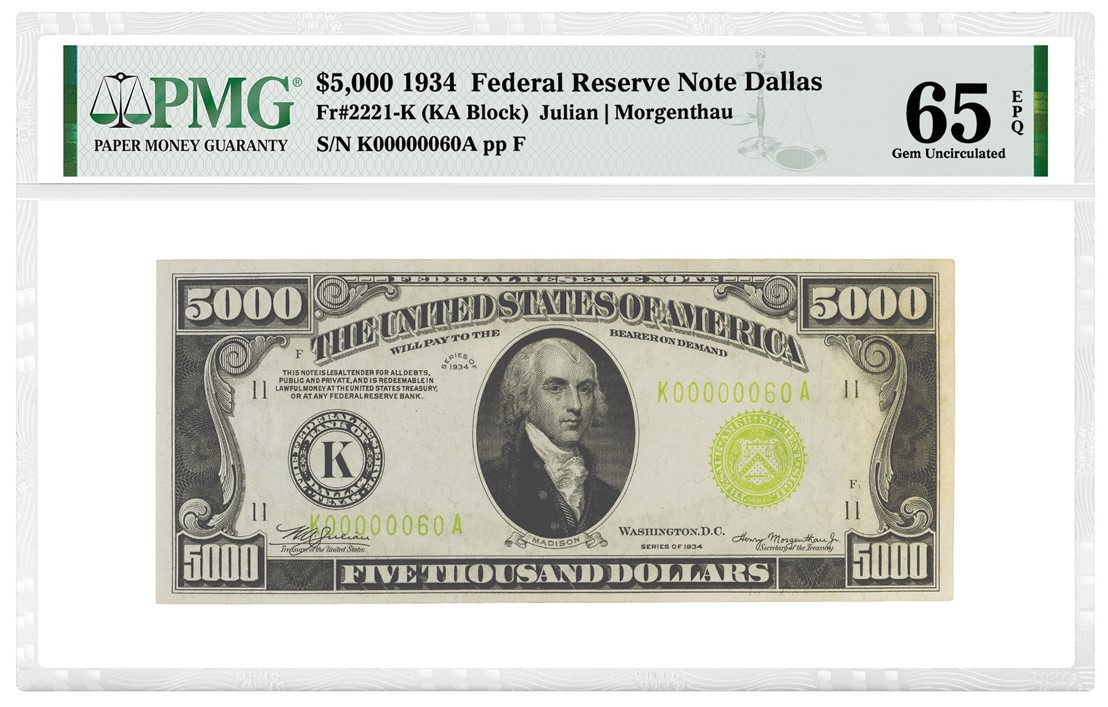

US high-denomination banknotes are fervently pursued by paper money collectors now as much as ever, as illustrated by a 1934 $5,000 Federal Reserve note (Dallas) that realized $252,000 in an August Stack’s Bowers sale.

Last month, Heritage Auctions sold a Superman #1 (DC, 1939) graded CGC 5.0 for $360,000, demonstrating that the most sought after comic book titles continue to command high prices and exceed Overstreet values at auction.

In July, CCG announced the upcoming launch of Certified Sports Guaranty (CSG) , a company dedicated to the third-party authentication and grading of sports cards and memorabilia, and indeed the sports card market is booming. A 2009 Mike Trout rookie card recently sold for $3.93 million at auction, making history and making modern coins, banknotes and comic books look very reasonable!

These sums are indicative of the strength of the collectibles markets, which I believe will only gain momentum in the future. There are several reasons for this.

First, more information and data continue to become available online, making our industry more transparent by the day. The CCG companies have long been at the forefront of providing free educational and collecting resources on our websites, including price guides, population reports showing relative rarity and registries that make collecting easier and more fun.

The utility and importance of these resources is evidenced, in part, by the incredible growth in registry set collecting during the pandemic. Since January, nearly 5,000 people have joined the NGC Registry, bringing our total to nearly 20,000 participants. The number of sets has risen to more than 175,000, up 40,000 from the beginning of the year.

The rapidly growing popularity of online registry set collecting is another factor that increases demand. For example, one dealer called attention to the fact that there is high demand for $25 Gold Eagles in NGC MS 69 because many collectors are building all MS 69 sets. This phenomenon is raising the price of NGC MS 69s.

US high-denomination banknotes are fervently pursued by paper money collectors now as much as ever, as illustrated by a 1934 $5,000 Federal Reserve note (Dallas) that realized $252,000 in an August Stack’s Bowers sale.

Second, as the CCG companies certify more collectibles, we are building a bigger market, which compresses buy-sell spreads and increases pricing consistency. For example, the buy-sell spread for most US gold coins is minuscule, and 1907 High Relief $20 Saint-Gaudens gold coins — highly distinctive vintage rarities — trade for virtually the same price in the same grade. Similarly, in the comic world, Amazing Spider-Man 300 and The Incredible Hulk 181 are titles that sell within an incredibly tight range.

With a fast-growing and evolving market, however, deciding what to buy and how much to pay can be complex, which brings me to my final point — dealers have an integral role to play right now.

Easy access to information is a good thing, but sometimes it can be overwhelming. New collectors will benefit immensely from the knowledge and guidance of an experienced dealer, and dealers can inspire the passion that makes a true collector. Indeed, while many collectibles have become commodities, they can still inspire very intense emotional connections, which can only help to grow the markets.

To appeal to today’s collectors, it is important for dealers to embrace all types of collecting interests. The art world has shown that people buy what they like, not necessarily what is most venerated in art history books. If a well-heeled buyer finds a Warhol more appealing than a Monet, she will buy the Warhol and pay as much or more for it. Likewise, modern coins are bringing the same prices as coins from the 1800s. Dealers need to diversify.

For new collectors, while you may know what you like, you want to be sure you know exactly what you are getting — and that you are not overpaying for it. This is where an experienced dealer can inform and guide you to make wise purchases. The NGC, PMG and CGC websites provide dealer locators to help collectors find Authorized Dealers.

Now is truly an exciting time to be part of the collectibles community. We are only in the earliest stages of the convergence of the collecting and investing worlds, and there are still incredible opportunities for growth. As always, third-party certification has and will provide the confidence, transparency and security that are necessary to support our vibrant markets and propel them forward.

All my best,

Mark Salzberg

Chairman

About Numismatic Guaranty Corporation® (NGC®)

NGC is the world’s largest and most trusted third-party grading service for coins, tokens and medals, with more than 47 million collectibles certified. Founded in 1987, NGC provides an accurate, consistent and impartial assessment of authenticity and grade. Every coin that NGC certifies is backed by the comprehensive NGC Guarantee of authenticity and grade, which gives buyers greater confidence. This results in higher prices realized and greater liquidity for NGC-certified coins. To learn more, visit NGCcoin.com.

About Paper Money Guaranty® (PMG®)

Founded in 2005, PMG is the world’s largest and most trusted third-party paper money grading service, with more than 5 million banknotes certified. PMG has established the industry’s highest standards of accuracy, consistency and integrity. Every note that PMG certifies is backed by the comprehensive PMG Guarantee of authenticity and grade, which gives buyers greater confidence. This results in higher prices realized and greater liquidity for PMG-certified notes. To learn more, visit PMGnotes.com

About Certified Guaranty Company® (CGC®)

CGC is the world’s largest and most trusted third-party grading service for comic books, magazines, concert posters and related collectibles, with more than 6 million collectibles certified. Founded in 2000, CGC revolutionized comic book collecting when it became the first company to provide expert and impartial grades to comic books and encapsulate them in secure, tamper-evident holders. In the years since, collectors the world over have embraced the expertise, integrity and passion of CGC’s graders, as well as the enhanced protection and display of the CGC holder. To learn more, visit CGCcomics.com

About Certified Collectibles Group® (CCG®)

CCG comprises seven of the world’s leading collectibles services companies: Numismatic Guaranty Corporation® (NGC®), Numismatic Conservation Services™ (NCS®), Paper Money Guaranty® (PMG®), Certified Guaranty Company® (CGC®), Classic Collectible Services® (CCS®), Authenticated Stamp Guaranty® (ASG®) and Collectibles Authentication Guaranty® (CAG®). The CCG companies provide expert and impartial services that add value and liquidity to a wide variety of collectibles, including coins, banknotes, comic books, magazines, concert posters, stamps and estate items. Today, the CCG companies have certified nearly 60 million collectibles and maintain offices in Sarasota, Florida; London, England; Munich, Germany; and Shanghai and Hong Kong, China. To learn more, visit collectiblesgroup.com

© 2020 Certified Collectibles Group. All rights reserved .

NGC, NCS, PMG, CGC, CCS, ASG, CAG and CCG are the registered trademarks or unregistered trademarks of Numismatic Guaranty Corporation of America, and/or its related companies in the United States and/or other countries. All other names and marks referenced in this release are the trade names, trademarks, or service marks of their respective owners.

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to Monthly Greysheet for the industry's most respected pricing and to read more articles just like this.