Proof Silver Coins in Simpson V Coin Auction: The Super Simpson Collection, Report #4

On April 23, at the Heritage headquarters near the Dallas Fort Worth airport (DFW), the fifth auction session of coins and patterns from the Bob Simpson Collection was conducted. The not yet revealed story regarding the Simpson V session is that Proof 19th century dimes, half dimes, and Three Cent Silvers fared surprisingly well and that increases in prices for these have been largely unnoticed in the coin community.

On April 23, at the Heritage headquarters near the Dallas Fort Worth airport (DFW), the fifth auction session of coins and patterns from the Bob Simpson Collection was conducted. The not yet revealed story regarding the Simpson V session is that Proof 19th century dimes, half dimes, and Three Cent Silvers fared surprisingly well and that increases in prices for these have been largely unnoticed in the coin community.

There are thus two parts to this not yet revealed story. The first is that market levels for Gem Proof Three Cent Silvers, Liberty Seated half dimes, Liberty Seated dimes and Barber dimes have recently increased in value.

The second is that many prices realized for these in the Simpson V session were beyond the new market levels. In another words, some pertinent prices realized were reflective of market levels and others were ‘above market’! Portions of some prices realized were a function of this one auction session and not reflective of markets at large. Each major auction has ‘a life of its own.’

An already told story concerns the very strong prices for many ‘top pops’ [ https://www.greysheet.com/news/story/top-pops-soar-in-simpson-iv-coin-auction ] in the Simpson IV sale in February. ‘Top pops’ are coins that are among the five highest certified by a grading service for their respective types, formats and dates. ‘Top pops’ brought strong prices in the Simpson V session, too, though prices for these in April were nowhere near as strong as they were in the Simpson IV session in February.

I am here referring to U.S. coins, not patterns. Simpson’s epic collection of patterns has been widely discussed among collectors and dealers, and was addressed in my first Simpson report

[ https://www.greysheet.com/news/story/auction-preview-the-super-simpson-collection-report-1-rarities-in-january ]. Simpson’s patterns should really be analyzed separately.

U.S. patterns require explanations for their respective meaning and market levels to be effectively discussed. Clearly, the market for patterns is healthy.

Rare date gold coins in general and CAC approved, gold condition rarities have risen in value in 2021. Market levels for most early copper coins continue to trend downward. I was surprised to discover that some Gem Proof (65 to 68 grade) silver coins have recently risen in value to a substantial extent.

As for whether PR60 to -64 silver coins increased in value over the same time period, I have not yet drawn a conclusion. My research about Proof half dollars is also incomplete, though preliminary findings suggest that some Proof Liberty Seated half dollars have risen in value during recent months. Gem Proof silver dollars and Trade dollars, however, have not risen in value during the same time period, as best as I can tell.

It is important to distinguish increases in market levels from auction results. It is impossible to gauge changes in market levels by analyzing results in any one auction, or even in two or three auctions. An analysis of the prices realized in an auction involves determining which results are wholesale prices, retail prices, super-retail prices or prices around the wholesale/retail border, which I call moderate prices.

A Greysheet Bid price is similar to my concept of a moderate price, Put differently, my notion of a price around the wholesale/retail border is similar to the Greysheet Bid concept of an estimate of how much a dealer who really demands a coin will pay for it, not a price that all interested dealers will pay. To pay a Greysheet Bid price, a dealer usually has to have a particular reason to buy the respective scarce or rare coin. It is implied that most dealers will not be willing to pay Greysheet Bid prices for all or even most U.S. coins.

Most dealers cannot be paying top wholesale prices for all scarce and rare coins. Greysheet Bids for common coins are a different matter and are not relevant to this discussion as many common coins are traded among dealers as commodities.

In an auction, a retail level price realized is strong and a super-retail price is very strong, a result above a medium retail range. To analyze the prices realized in an auction, there is a need to first have comprehensive knowledge of market levels. It is impossible to understand market levels merely by reading auction results.

I am providing examples here to illustrate the theme that Gem Proof Three Cent Silvers, Liberty Seated half dimes, Liberty Seated dimes and Barber dimes have recently risen in value. As of May 24, 2021, most or all such gains in market levels have not been well reflected in price guides.

Unfortunately, it is not practical to now discuss all the Gem Proof silver coins in the Simpson V session. Proof silver dollars and Trade dollars tended to realize moderate prices in the context of levels that prevailed last year or earlier. Values of Proof silver dollars and Trade dollars have not trended upward for a long time.

The Carter-Simpson 1884 Trade dollar did bring a strong price, $480k. Market levels for 1884 and 1885 Trade dollars have not increased over the past three years. Markets for classic (pre-1934) U.S. Proof silver coins in general showed minimal signs of energy from 2015 to 2020. This is a reason why I was intrigued by recent market increases for some Gem Proof silver coins

Almost all Gem Proof Three Cent Silvers have increased in value, not just ‘top pops.’ A ‘top pop’ that brought super price was Simpson’s 1857 Three Cent Silver that was PCGS certified as Proof-66 and CAC approved.

Neither PCGS nor NGC has certified a Proof 1857 Three Cent Silver as 67 or higher. PCGS has certified five as Proof-66 and CAC has approved three as Proof-66, including the Simpson coin. The price realized, $43,200, is more than double the PCGS price guide value, $19,500, and more than the double the CPG-CAC retail price estimate of $20,400. The price guide values should be increased, though they should not be doubled. This $43,200 price incorporates both an increase in the market level and and an amount above the new market level that stems from the dynamics of this one auction session.

The least expensive Three Cent Silver in the Simpson V session is one of the best certified Proof-65 Three Cent Silvers of any date. Although 1859 is not a rare date in the series of Proof Three Cent Silvers, this coin is a true Proof that was minted before the U.S. Civil War. This 1859 is PCGS certified as Proof-65 and has a sticker of approval from CAC. It is a very attractive coin overall, with pleasant natural toning.

The design elements overall are better defined than they are on most Proof Three Cent Silvers. Additionally, there are no bothersome hairlines and contact marks. This coin brought a moderate to strong price, $2200, and I suggest that price guides have underestimated the value of this coin.

Although well above a wholesale level, the $2200 result was a good deal from a logical perspective. Coin enthusiasts can enjoy collecting pre-1861 Proofs without spending a fortune.

https://coins.ha.com/itm/three-cent-silver/two-and-three-cents/1859-3cs-pr65-pcgs-cac-pcgs-3708-/a/1329-4101.s

The 1866 Three Cent Silver in the next lot is excellent, too! This coin is

PCGS certified as Proof-66 and CAC approved. The obverse is extremely

attractive. There are cool die finishing lines in the inner fields. The

mostly russet shield contrasts wonderfully with the blue tones on the outer

regions of the obverse star. There is a soothing cameo contrast about the

legend. The russet, blue, green and magenta hues at various parts of the

coin are well balanced and very appealing. The $2640 result was strong,

though not as strong as it appears to be to someone who focuses on price

guides.

https://coins.ha.com/itm/three-cent-silver/two-and-three-cents/1866-3cs-pr66-pcgs-cac-pcgs-3716-/a/1329-4102.s

A CAC approved, PCGS certified Proof-66+ 1868 Three Cent Silver realized

$5280. Even after taking into consideration higher market levels for Proof

Three Cent Silvers, it is clear that this coin brought a strong to very

strong price, really well above a medium retail level.

The CPG-CAC retail estimate for a Proof-66 1868 is $1750. The PCGS price guide value for a Proof-66+ 1868 Three Cent Silver is $4250, more than twice the PCGS price guide value for a Proof-66 without a plus.

I was enticed by this coin. The originality, underlying vibrant mirrors, neat pale blue-green overtones, russet and green obverse inner fields, green plus tan two-tone reverse and overall coolness altogether had an impact on me.

https://coins.ha.com/itm/three-cent-silver/two-and-three-cents/1868-3cs-pr66-pcgs-cac-pcgs-3718-/a/1329-4103.s

A couple of Proof Three Cent Silvers that were not in the Simpson

Collection, though were in the same auction extravaganza, are mentioned to

illustrate the point that Proof Three Cent Silvers have been increasing in

value. It is important to keep in mind, however, that a list of a few

examples does not demonstrate that market levels have changed. If the same

coin sells for a wholesale price in one auction and then later sells for a

retail price in another auction, it would be wrong to conclude that it rose

in value without additional evidence. A large amount of data in combination

with an advanced understanding of coin markets enables an analyst to form

solid hypotheses about changes in market levels, though precise market

levels for rare coins are not entirely knowable.

In April 2021, Heritage auctioned an NGC certified PR67 1865 Three Cent Silver for $4500. In February 2018, Legend auctioned this exact same coin in the same NGC holder for $3520.

https://coins.ha.com/itm/three-cent-silver/two-and-three-cents/1865-3cs-pr67-ngc-pcgs-3715-/a/1329-3277.s

Near the end of the Heritage auction event in April, a CAC approved, PCGS certified Proof-66-Cameo 1871 Three Cent Silver was auctioned for $4320. In February 2016, Heritage auctioned the exact same coin with the same PCGS serial number for $2350. Although there were some increases and decreases along the way, market levels for 19th century silver type coins trended downward from 2015 to 2020, so this comparison of auction results for the same 1871 coin is another piece of evidence that market levels for Gem Proof Three Cent Silvers recently increased.

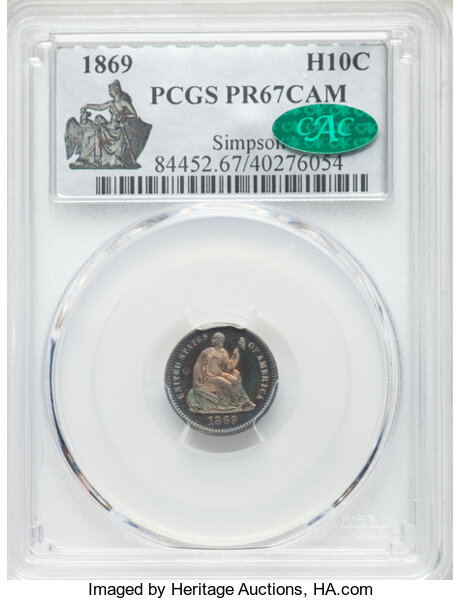

Unquestionably, the $7500 result for the Simpson Collection, CAC approved, Proof-67-Cameo 1869 half dime was a very strong price. The Greysheet-CAC Bid price of $3000 is low, in my estimation. A moderate price would have been around $4750.

https://coins.ha.com/itm/seated-half-dimes/half-dimes/1869-h10c-pr67-cameo-pcgs-cac-pcgs-84452-/a/1329-4114.s

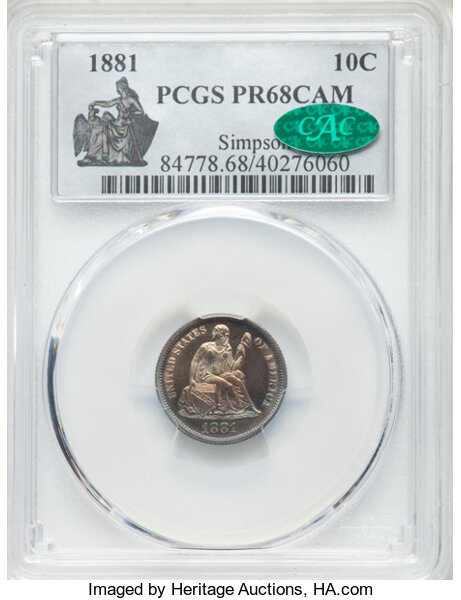

The Simpson Collection, CAC approved, PCGS certified Proof-68-Cameo 1881

dime realized $11,400. While this might seem to be a very strong price, I

figure that this result just incorporates a CAC premium and relates to this

coin’s ‘top pop’ status; this is the only Proof-68 1881

dime of any sort that has been approved by CAC.

https://coins.ha.com/itm/seated-dimes/dimes/1881-10c-pr68-cameo-pcgs-cac-f-101-r3-pcgs-84778-/a/1329-4117.s

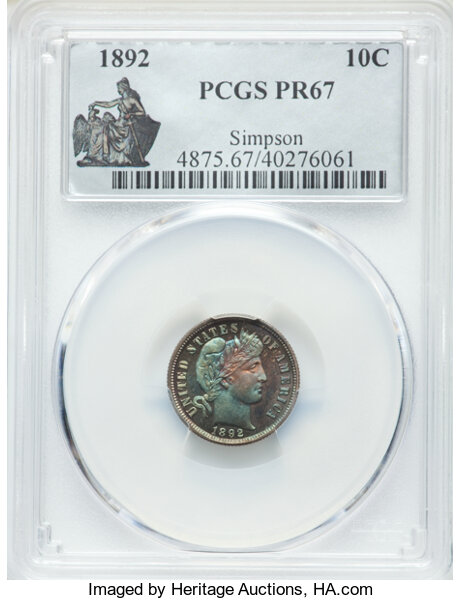

A PCGS certified Proof-67 1892 dime realized $2520. Heritage auctioned

other PCGS certified Proof-67 1892 dimes for $2160 in January 2021 and for

$1680 in February 2020. Another was sold by GreatCollections in May 2018

for $1743.75. While the current Greysheet Bid for this coin, $1450, is too

low, I am not suggesting that it should be above $2000. Perhaps $1770 is

the right number for a Greysheet Bid, with a CPG retail value estimate of

$2200. The $2520 auction result for this 1892 dime was very strong.

https://coins.ha.com/itm/barber-dimes/dimes/1892-10c-pr67-pcgs-pcgs-4875-/a/1329-4118.s

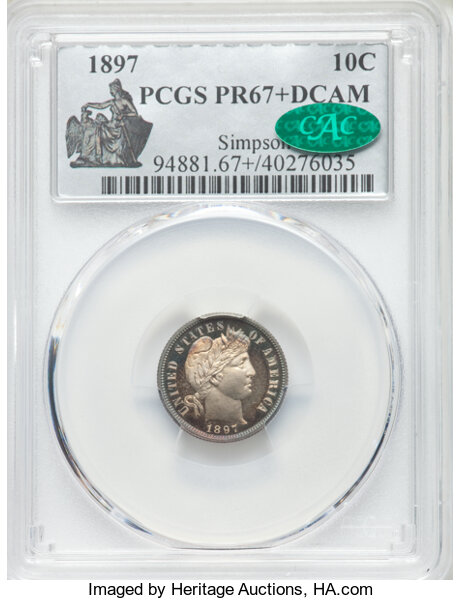

The 1897 dime in the Simpson V session was PCGS certified as Proof-67-‘Deep

Cameo’ and has a sticker of approval from CAC. There are many certified

Proof-67 1897 dimes. This coin is a ‘top pop’ in the minds of collectors

who take the ‘Deep Cameo’ designation too seriously. The distinction

between a Cameo and a ‘Deep Cameo’ contrast is extremely ambiguous and such

a concept was not very important to most relevant collectors during the 20 th century. In any event, the $14,400 result is clearly strong.

A moderate price in April 2021 would have been around $10,750, which is

more than a moderate price would have been in 2019 or the middle of 2020.

https://coins.ha.com/itm/barber-dimes/dimes/1897-10c-pr67-deep-cameo-pcgs-cac-pcgs-94881-/a/1329-4119.s

The $3240 result for the Simpson Collection, CAC approved, PCGS certified

Proof-66 1901 dime is reflective of both the increase in market levels for

Proof Barber dimes and the strength, beyond market levels, of the prices

realized for some Proof silver coins in the Simpson V session. Indeed, the

$3240 result is extremely strong.

In October 2019, a CAC approved, Proof-66-Cameo 1901 dime was auctioned for $1762.50, barely more than half as much as the Simpson 1901 just realized. In March 2013, when market levels were higher than they are now, a PCGS certified Proof-66 1901 dime, with a CAC sticker, was also auctioned for $1762.50.

The current PCGS price guide value is $1350, which is too low. The current Greysheet-CAC Bid is $1000 and the CPG-CAC retail estimate is $1250. These are too low, too. I suggest a Greysheet-CAC Bid of at least $1500. A moderate price for this PCGS certified Proof-66 1901 dime would have been in the range of $1500 to $1650 or so. A fair retail price would be in the range of $1775 to $2250.

The corresponding market level is one of several factors that influence auction results. Collectors who note this auction result should not think that a CAC approved Proof-66 1901 dime is worth anywhere near as much as $3240. If there had been a major coin convention or expo in March, April or May 2021, a collector walking on the bourse floor would probably not have been able to sell a CAC approved Proof-66 1901 dime for half the amount that this Simpson 1901 realized in April, even though market levels for Proof Barber dimes have been rising.

The Simpson Collection, PCGS certified Proof-67+ 1906 dime, with a CAC sticker, realized $6000. This is one of two that are so certified and CAC approved. The other was auctioned by Heritage for $5175 in January 2012, when market levels were a little higher than they are now. Indeed, market levels for Proof Barber dimes declined considerably from some point in 2015 to 2019 or 2020. After taking recent increases in market levels into consideration, I figure that the $6000 realization is definitely a retail price, though it is not a very strong result.

https://coins.ha.com/itm/barber-dimes/dimes/1906-10c-pr67-pcgs-cac-pcgs-4890-/a/1329-4121.s

A CAC approved, PCGS certified Proof-68 1910 Barber dime realized $18,000.

PCGS has certified three as PR68, one as PR68+ and two as PR68-Cameo.

Although there are not many auction records for certified PR68 1910 dimes,

other CAC approved PR68 Barber dimes of similar condition rarity tended to

sell for less than $12,500 each over the last five years. The recent

increase in market levels for Gem Proof Barber dimes might explain a

$14,000 to $16,000 result, though not an $18,000 result.

I have examined hundreds of Gem Proof Barber dimes. I have been very fond of them since I was a kid. While this Simpson 1910 is very attractive, it is not one of the most spectacular Proof Barber dimes that I have ever seen. I would be flabbergasted if it was upgraded to 69!

The buyer or the underbidder may have been thinking that this coin will eventually receive a Cameo designation. Is it likely, though, that a PCGS certified PR68-Cameo 1910 dime, with a CAC sticker, could be sold for more than $18,000 in the present? Indisputably, this was a very strong price for this coin in its current holder on April 23, 2021.

https://coins.ha.com/itm/proof-barber-dimes/1910-10c-pr68-pcgs-cac/a/1329-4122.s

On April 22, a CAC approved, NGC certified Proof-67 1891 dime realized

$3360. This dime was not in the Simpson Collection. In January 2019, a CAC

approved, PCGS certified Proof-67-Cameo 1891 dime sold for $2880. While one

piece of circumstantial evidence might not mean anything, dozens of pieces

along with accumulated knowledge and information from other sources

altogether may prove a point.

https://coins.ha.com/itm/seated-dimes/dimes/1891-10c-f-130-r3-pr67-ngc-cac-pcgs-539071-/a/1329-3376.s

Market levels so far in 2021 have been more interesting than they have been

in years. With some segments of coin markets clearly rising, some areas

trending downward and the values of many scarce coins holding steady, there

is much suspense in regard to auction events and coin shows that will occur

during the rest of 2021.

Copyright ©2021 Greg Reynolds

Insightful10@gmail.com

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to Monthly Greysheet for the industry's most respected pricing and to read more articles just like this.

Source: Greg Reynolds