Recent CAC Premiums For 1928 Saints: Study & Analysis

Greg Reynolds takes a deep dives into one of the most common Saint Gaudens $20 double eagles as a case study for valuation.

The markets for the most popular of all CAC approved gold coins are very difficult to analyze. These are gem quality Saint-Gaudens double eagles of the most common dates, usually 1924, 1925, 1927 and 1928 Philadelphia Mint coins. The purpose here is to explain the factors that must be considered in order to attain some understanding of CAC premiums for these.

I am referring to CAC approved Saint-Gaudens $20 gold coins that are NGC or PCGS certified as grading MS65, MS66 and MS67, gem grades. These are among the most liquid of all quality, classic U.S. coins. They tend to stay in dealer inventories for a very short term, often for less than an hour. An underlying theme here is an examination of trends in the values of CAC approved choice to gem mint state Saints since the inception of The CAC Rare Coin Market quarterly, a CDN publication, in August 2019.

Saints are Saint-Gaudens double eagles (U.S. $20 gold coins), which were minted from 1907 to 1933. Of the With Motto type, CAC has approved Saints dating from 1908 to 1932. While some of the most common classic U.S. coins are Saints of the With Motto type, this series includes several rarities as well. Of this With Motto type, there are dates for which fewer than five hundred exist in all grades. For the most common dates, more than 100,000 of each survive. There may be more than one million 1924 Saints around.

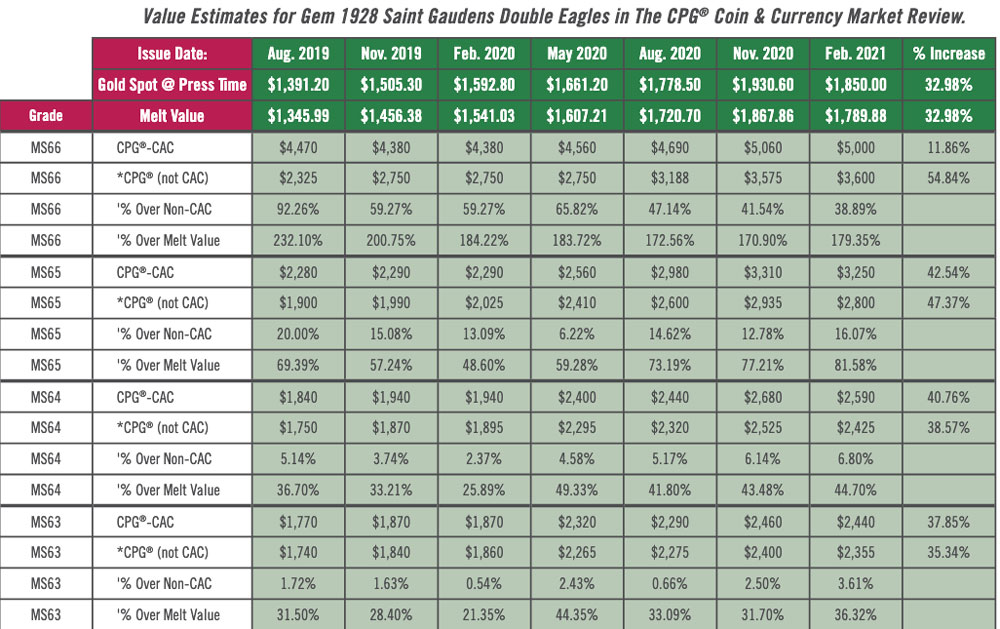

As The CAC Rare Coin Market Review is the only periodical devoted to value estimates of CAC approved coins, and enables newcomers to easily learn about these value estimates, this publication is an appropriate source for data regarding recent trends in the values of CAC approved, MS65 and MS66 grade Saints. These are the cream of generic gold coins.

As CAC approved MS67 grade Saints are relatively rare, they should be addressed separately, rather than in a discussion of generic coins. Generics are extremely common, classic U.S. coins. Primary examples are: 1880-S, 1881-S and 1882-S Morgan silver dollars, 1901-S $10 gold coins 1904 Liberty Head double eagles. Various Saints, especially 1924, 1927 and 1928 coins, are leading examples of generics.

As 1924 is the most common and most likely to be telemarketed, the focus here is on 1928 Saints, which are the second most common. These are often seen at coin shows and in coin stores. They tend to have a cool and enticing appearance, which attracts collectors.

CAC premiums manifest themselves primarily in gem grades, MS65 to MS67. For a 1928 Saint that is NGC or PCGS graded MS63, the difference in value is slight. According to the CPG® retail price guide, this difference on April 1 was about $40; $2,330 for a CAC approved MS63 grade 1928 Saint and $2,290 for a non-CAC, NGC or PCGS graded MS63 1928 Saint.

For a NGC or PCGS graded MS67 1928 Saint, the CAC premium is much larger, percentage-wise and in absolute terms. On April 1, the CPG® retail estimate for a non-CAC MS67 1928 Saint was $14,400 and the CPG ® estimate for a CAC approved MS67 1928 Saint was $28,500, nearly twice as much. CAC approved, gem quality common date Saints are in a realm of their own.

While it understandable that coin collectors would be willing to pay premiums for CAC approved coins for sets, the premiums for common date Saints are puzzling and more complicated. There could not be more than fifty people currently assembling sets by date (and mint location) of Saints in gem grades.

If a collector demands a CAC approved 20th century gold coin in MS67 grade, then a Saint would be a logical selection. It is impossible to assemble a 20th century, CAC-only gold type set with all coins grading MS67. CAC has approved zero Indian Head quarter eagles at the MS67 grade level.

Just forty-two Indian Head quarter eagles have been CAC approved at the MS66 level. Only two Indian Head half eagles are CAC approved as grading MS67. Furthermore, CAC has approved only seventeen Indian Head With Motto eagles (U.S. $10 Gold coins) as MS67. These were minted during the same time span as With Motto Saints.

An immediate point is that CAC approved gem quality Saints are far more plentiful than CAC approved gems of any other gold series. Nonetheless, CAC approved MS67 grade Saints seem rare when compared to CAC approved MS66 and MS65 grade Saints.

CAC has approved seventy-seven With Motto Saint-Gaudens double eagles as MS67, twenty-three of which are 1928 Philadelphia Mint coins. Twenty-nine are 1924 Saints, the most common date, so fifty-two Saints of the two most common dates are CAC approved at the MS67 level. I figure that fewer than thirty of these are in type sets. Besides, someone assembling a gem quality type set of gold coins could select one of the more than 2,300 With Motto Saints that have been CAC approved at the MS66 level. Around 5,900 With Motto Saints have been CAC approved at the MS65 level.

It is inconceivable that more than five thousand collectors have placed CAC approved gem Saints in type sets. Not only are there more common date Saints than there are collectors who demand to buy them, there are more CAC approved gem Saints than there are collectors who are building pertinent date sets or type sets in any readily recognizable form. Clearly, there are hundreds of investors and speculators who have purchased CAC approved, gem quality Saints.

As CAC approved gold coins are difficult to inventory and non-CAC, PCGS or NGC graded MS65 to MS66 common date Saints are easy to acquire in quantities, it is unsurprising that relevant telemarketing firms usually sell non-CAC, PCGS or NGC graded Saints and do not emphasize CAC approved gems. The current PCGS populations for gem Saints are 123,418 in MS65, 3,831 in MS65+, 25,603 in MS66, 1,232 in MS66+, 378 in MS67, twenty-five in MS67+, and four in MS68 grade.

NGC has graded a large number, too. Of 1924 Saints alone, the NGC census is 36,218 in MS65, eighteen in MS65*, 615 in MS65+, 5,300 in MS66, fifty-two in MS66*, 213 in MS66+, 214 in MS67, two in MS67*, one in MS67+, and three as MS68.

There are wholesalers who tend to stock non-CAC, PCGS or NGC graded MS65 and MS66 Saints in quantities. CAC or not, MS65 and higher grade, common date Saints tend to retail for amounts well over the value of their gold bullion content. On April 1, 2021, around 5:00 PM, the Greysheet website reported that the price of gold was $1,728.30 per Troy ounce. This means that each uncirculated Saint then had a melt value of $1,672.13. An uncirculated Saint contains 0.9675 Troy ounce of gold.

In the first chart I included data from around 11/01/20 to 04/01/21. The November 2020 Monthly Greysheet cited a gold bullion value of $1,894.70. As the Monthly Greysheet does not include CPG® retail values and does not include CAC value estimates for all pertinent grades, I extrapolated a few of the figures in both charts here, which I take to be consistent with the CDN-CPG® system. Besides, typographical or other errors may occur.

No one should rely heavily on data in this discussion while making buying

or selling positions. The data here is being used to illustrate concepts

and trends. The data presented here is not intended to be used as a tool

for speculation. I am not providing advice in this discussion. Indeed, I am

not now recommending for or against the purchase of any Saints. Coin buyers

are encouraged to read, research, observe, ask questions and think for

themselves.

It is apparent that CAC approved, gem quality 1928 Saints are worth

substantially more than their non-CAC counterparts. For AU58 to MS63 grade

1928 Saints, however, the difference in estimated value is small, in the

range of 0.4% to 2%. These tend to be worth between 32% and 40% above their

gold bullion content. While a premium over bullion in the range of 35% is

large for a common gold coin, it is small enough such that there could be a

substantial correlation with changes in gold bullion prices.

MS64 grade Saints constitute a dividing line. Demand for them is largely

independent of gold bullion values. MS64 grade generic Saints, though, are

not worth nearly as much as gems, MS65 and higher grade coins. Most

collectors of 20th century gold coins strongly prefer gems to MS64 grade

coins.

On April 1, a non-CAC, NGC or PCGS graded MS64 Saint was worth more than 40% over melt value. A CAC approved MS64 1928 Saint was estimated to retail for $2,620, 56.9% over melt, which was then $1,672.13.

Although the melt value was nearly 10% higher shortly before November 1, 2020, the CPG® retail value estimate, $3,310, for a CAC approved MS65 grade 1928 Saint was the same on April 1, 2021 as it was around November 1, 2020. The CPG® retail estimate for a non-CAC MS65 grade 1928 Saint fell about 6%, from $2,940 to $2,760 during the same time period.

The CPG® retail estimate for a CAC approved MS66 Saint was also the same on April 1, 2021, $5,060, as it was around November 1, 2020. On April 1, it was more than three times the melt value of a double eagle.

A primary reason for the second chart is to present the CPG®-CAC retail estimates for choice to gem grade 1928 Saints in every issue of The CAC Rare Coin Market quarterly since its inception in August 2019. The CPG ® retail estimates for corresponding non-CAC 1928 Saints are extrapolated from data on www.greysheet.com to approximate the CPG ® estimates that prevailed at press time for each respective issue of the CAC Rare Coin Market quarterly.

While gold in bullion form increased in value by 33%, MS63 to MS65 grade 1928 Saints, CAC or not, increased in value by even more. Price changes for MS66 grade Saints are puzzling. There was a surge in demand for non-CAC, NGC or PCGS graded MS66 1928 Saints, while CAC MS66 Saints rose in value to a modest extent, less than 12%.

It is unsurprising that price changes for MS63 grade 1928 Saints tended to

parallel changes in bullion levels more so than price changes for MS64 and

MS65 grade 1928 Saints. It is curious, though, that CAC approved MS63 grade

Saints tend to sell for just 0.5% to 3.5% over the prices of their non-CAC

counterparts.

Assuming that a buyer has already decided, for whatever reason, to acquire a quantity of MS63 grade Saints, it would probably be worthwhile to pay a 3.5% premium for CAC approved coins. The founder of and sole finalizer at CAC, John Albanese, is the leading expert in Saint-Gaudens double eagles.

For MS65 and MS66 grade Saints, the CAC premiums over corresponding non-CAC coins varied tremendously from August 2019 to February 2021, and the premiums over melt value for CAC approved coins varied to a large extent, too. If there is any relationship between changes in the market levels for CAC approved MS65 or MS66 1928 Saints and changes in prices of gold bullion, it is not evident in this data sample. Moreover, when I researched generic gold in 2011, I found very little correlation between market levels for MS64 to MS67 grade generic gold, including 1928 Saints, and gold bullion levels. Since 2019, however, there does seem to be substantial correlation between price changes for generic Saints that grade below MS64 and gold bullion prices.

When the February 2020 CAC Rare Coin Market quarterly went to press, gold

bullion was at $1,592.80. When the August 2020 issue went to press, gold

bullion was at $1,778.50, an 11.66% increase. During this same short

period, CAC approved MS66 Saints rose in value by only 7.08%, yet CAC

approved MS65 grade 1928 Saints rose in value by 30.13%, which was ahead of

the 28.4% increase in estimated values of non-CAC, NGC or PCGS graded MS65

1928 Saints.

CAC approved MS64 grade 1928 Saints rose in estimated value by 25.77%, more than twice the increase in value of gold bullion during this same short time period from press time for the February 2020 issue to the press time for the August 2020 issue. CAC approved MS64 grade 1928 Saints were three percentage points ahead for their non-CAC counterparts. All such data is misleading as many people examining such data seem to think that value increases are automatic or based in logic. In reality, values of 1928 and other generic Saints are very much affected by dealer advertising and/or promotional campaigns of telemarketing firms.

In my opinion, over the long run, CAC approved Saints are far more likely

than non-CAC Saints of the same respective certified grades to be

appreciated by people who are able to grade them. Moreover, CAC approved

Saints are likely to be very much desired by coin buyers who are honestly

advised by coin experts about the quality of individual coins. Speculation

and connoisseurship, however, are different pursuits. It does not

necessarily follow that a superior coin will rise in value to a greater

extent than an inferior coin.

Also, coin markets are cyclical. During some periods, both CAC approved Saints and their non-CAC counterparts will fall in value.

As there are more 1928 Saints overall than there are serious collectors who demand them, an understanding of markets for 1928 Saints involves analysis of the consequences of the behavior of speculators and the policies of telemarketing firms. It is practical to predict the future behavior of speculators and promoters?

In contrast, rare date Saints and most pre-1880 U.S. gold coins each have more of a collector base. The perspectives of serious collectors are large determinants of the values of these. In some cases, it is helpful to think about the ratio of the number of interested collectors to the number of surviving coins in a particular category. For example, the ratio of the number of very interested collectors to the number of pre-1808 U.S. gold coins in existence is very high.

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to CAC Rare Coin Market Review for the industry's most respected pricing and to read more articles just like this.

Source: Greg Reynolds