Popular items

Value Range: $36.45 - $21,600.00

Value Range: $42.65 - $68.00

Value Range: $36.45 - $31,200.00

Value Range: $22.95 - $43,200.00

Value Range: $36.45 - $96,000.00

Value Range: $36.45 - $17,300.00

Value Range: $36.45 - $28,800.00

Value Range: $36.45 - $96,000.00

Value Range: $32.06 - $14,400.00

Value Range: $32.06 - $6,130.00

Value Range: $36.45 - $66,000.00

Value Range: $36.45 - $16,200.00

Value Range: $36.45 - $45,400.00

Value Range: $36.45 - $6,500.00

Value Range: $520.00 - $1,380,000.00

Greysheet Catalog (GSID) Stats

Catalogs:

4Items:

279,584Values:

1,167,054Auction Records:

3,318,078Images:

7,688,000Greysheet News

View all news

The Czech National Bank release new gold coins as part of their current collector series.

This relatively strong performance falls right between the prior two editions of this sale.

The Bank of Israel launch new bullion gold coins in their on-going and popular series.

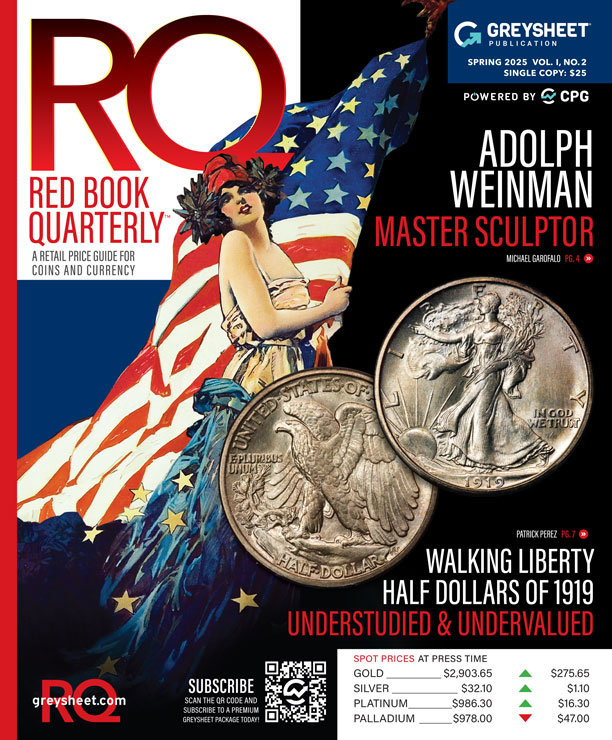

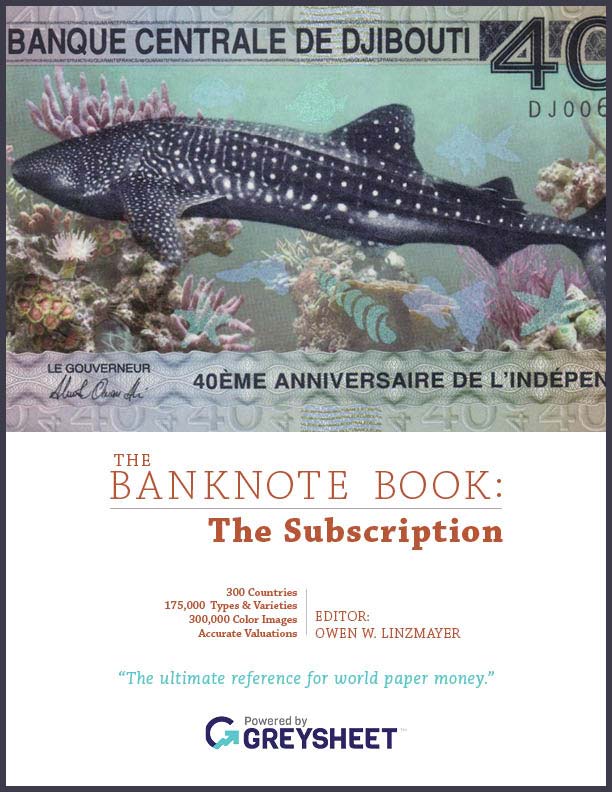

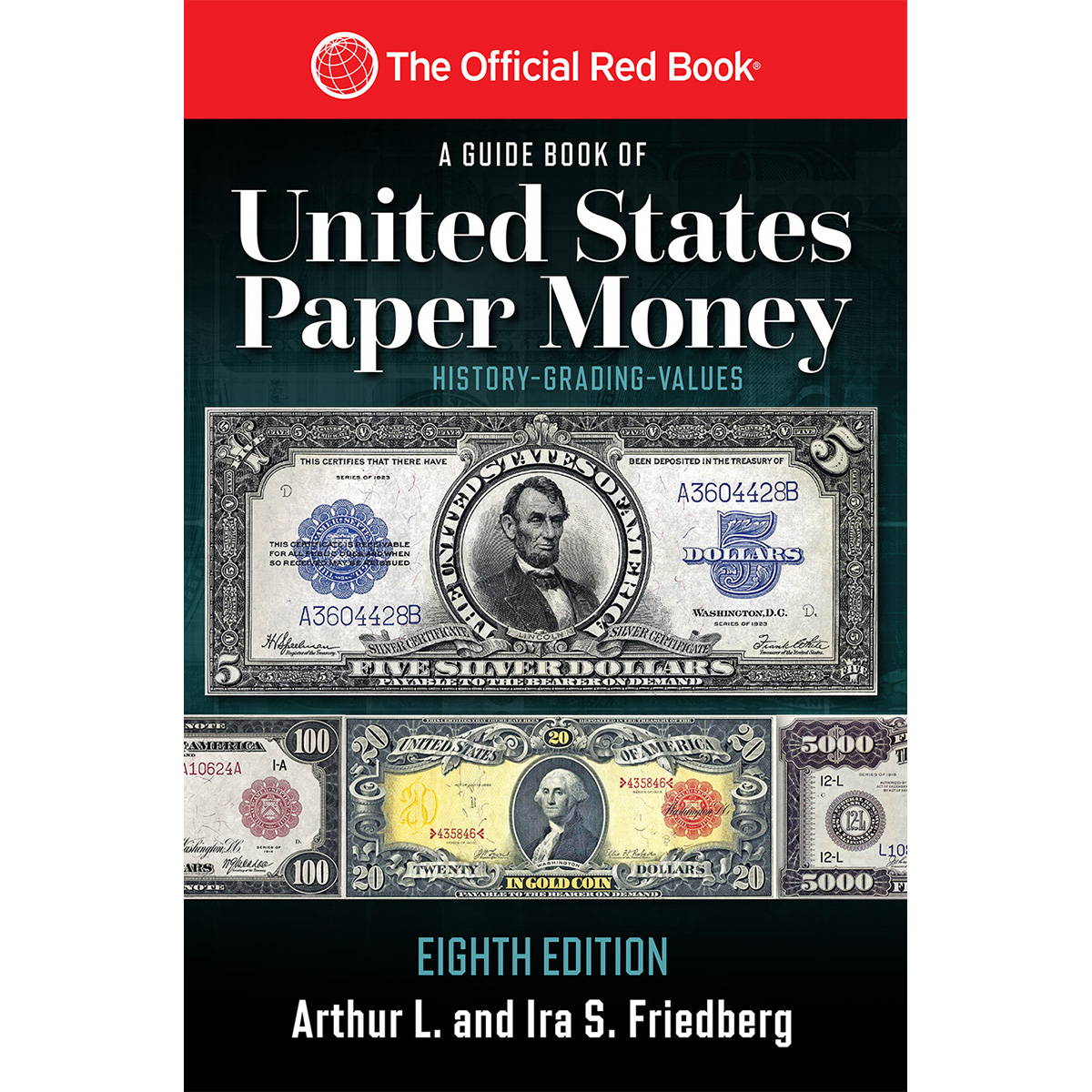

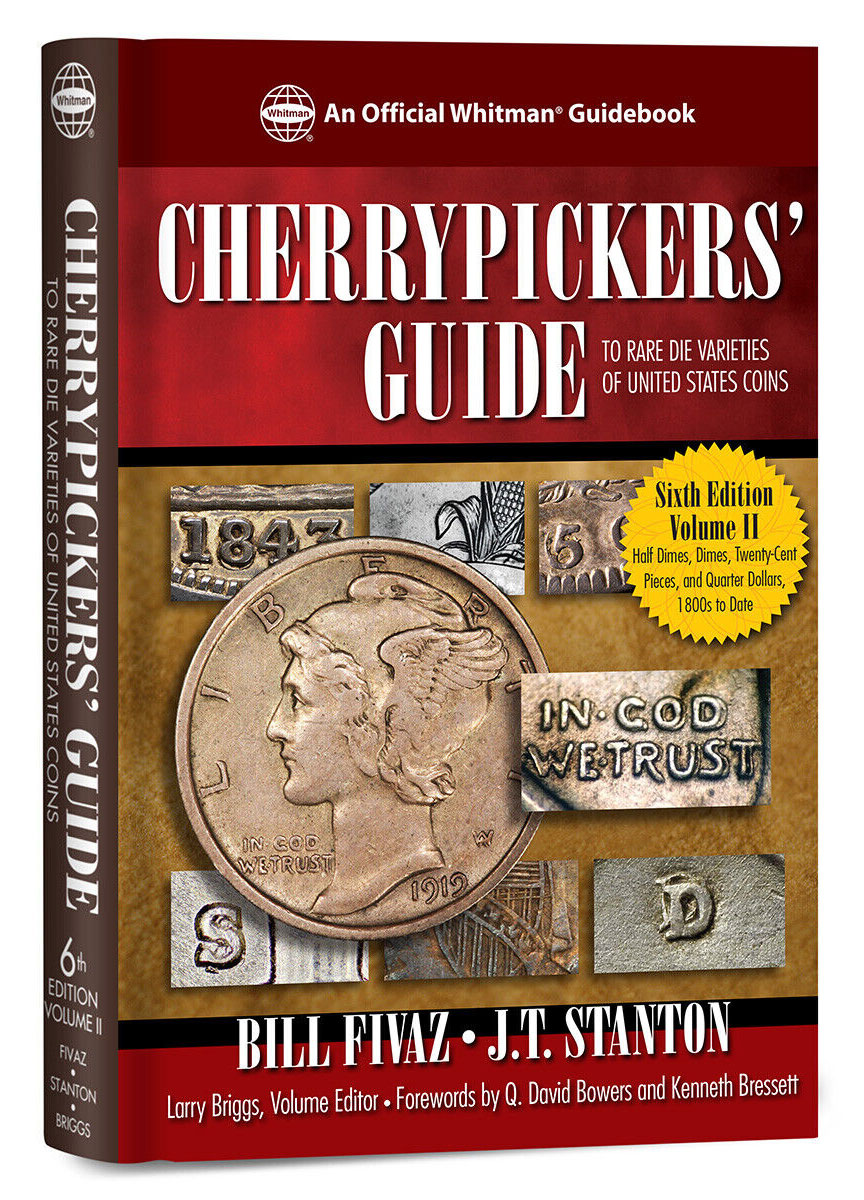

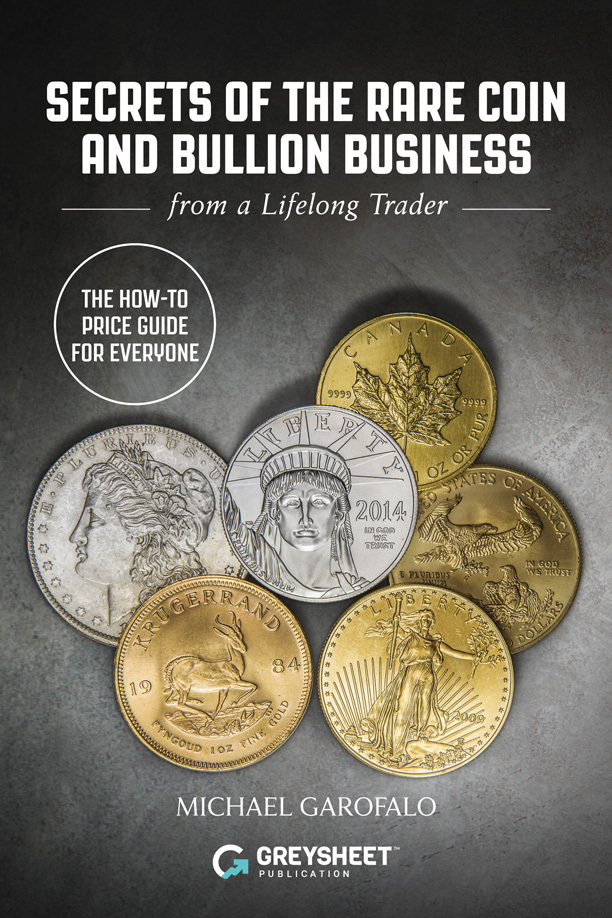

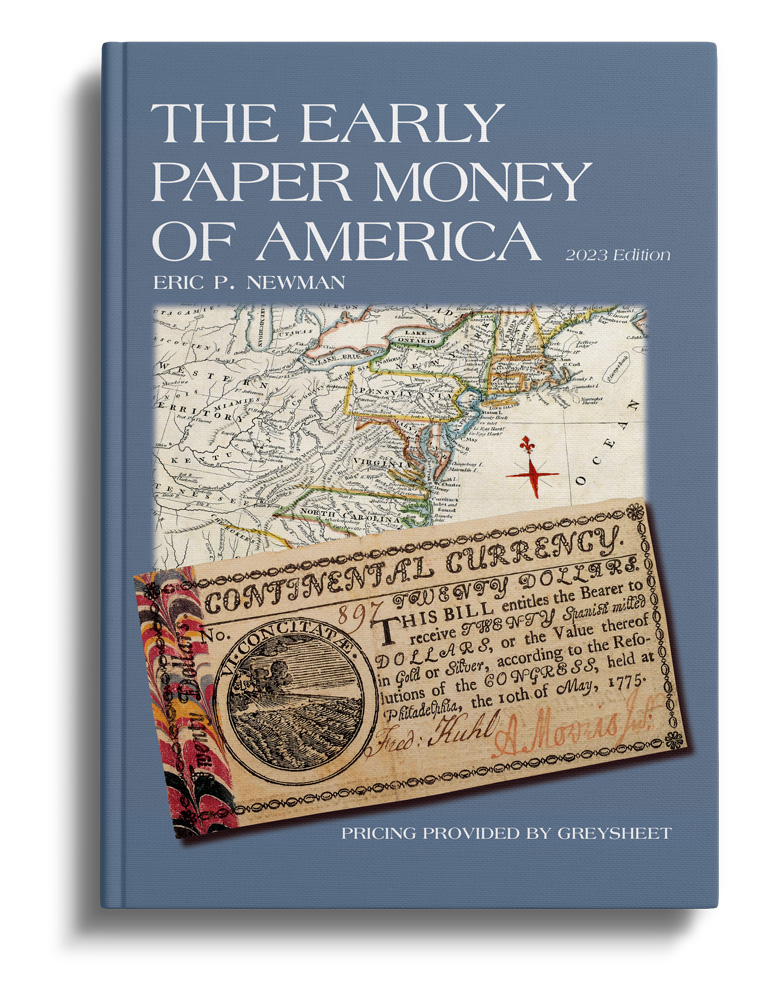

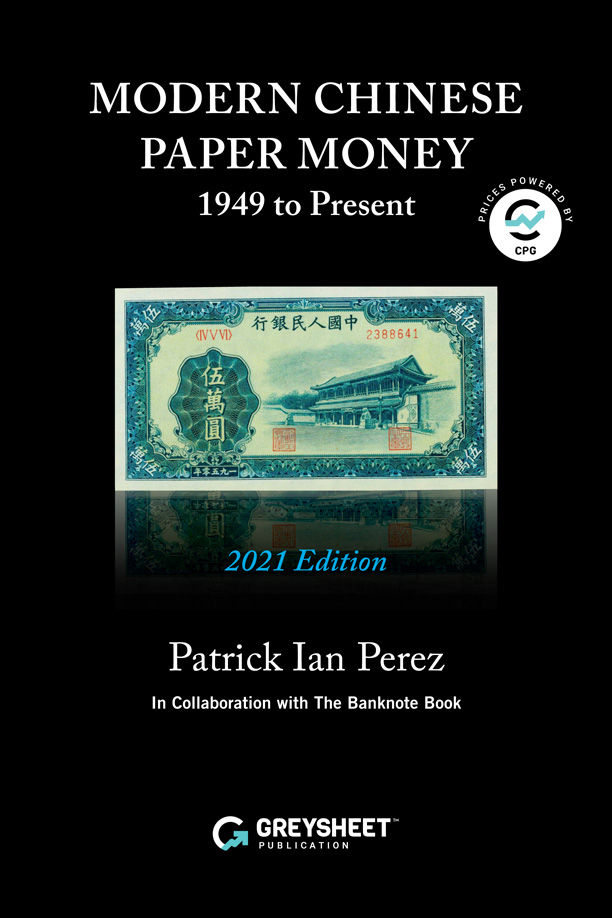

Our Publications

View subscription plans

Since 1963, the Greysheet has been a critical tool for numismatic professionals. Every serious dealer, investor & collector of U.S. coins keeps their copy at close hand!

A necessity for dealers, investors & serious collectors of U.S. bank notes.

Over 100 pages of coin pricing! Just $25 per issue with a subscription.

Comprising 328 individual country chapters (and growing!), with over 10,200 pages covering more than 105,000 types and varieties, the Banknote Book is the most comprehensive catalog of world paper money in existence.

The premier pricing guide for collectors, investors & dealers of CAC-approved certified U.S. coins.

New. Revised. Expanded. Now with photos in full color. For the numismatist, banker, economist, historian, or institution of higher learning, the tenth edition is a book for every library, public and private.

New research, new photographs, updated pricing, the latest U.S. Mint data, new auction records, and more!

- 448 pages

- 12,000 Listings pages

- 32,500 Coin prices

- Full color

8th Edition - complete source for History, Grading, and Values

15 Years in the Making! New research, new photographs, updated pricing, the latest U.S. Mint data, new auction records, and more...

Loaded with essential information for collectors, dealers, and investors.

The 2023 Edition fills 472 pages of this rare and indispensable guide to colonial paper money includes all-new pricing by the CDN editors of Greensheet, and now includes hundreds of color images.

This critical book is the only English-language reference of its kind on this popular collectible.

The 23rd Edition of the industry-standard reference book for U.S. Paper Money. A must-have companion for users of the Greensheet wholesale price guide.

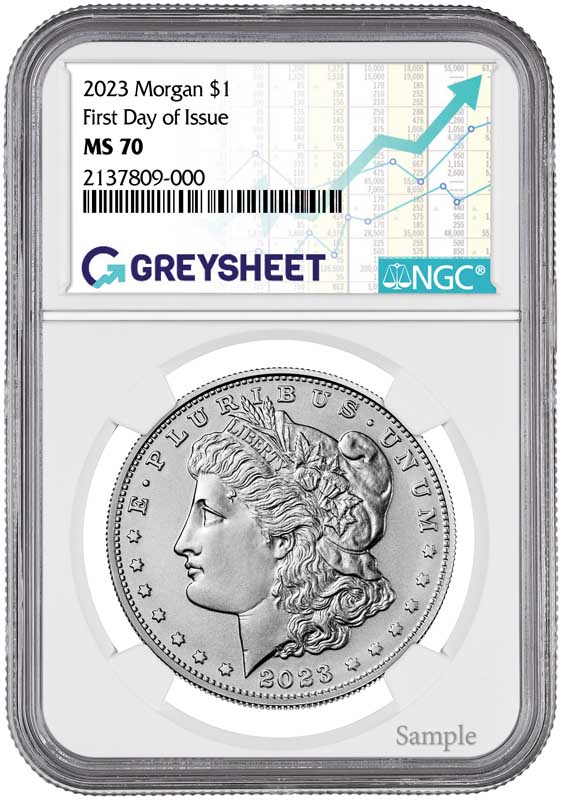

Exclusive Offer of First Day of Issue Coins from CDN Publishing

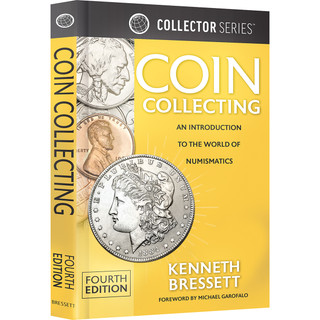

This 4th edition is an up-to-date, comprehensive guide that explains everything a new collector should know about to succeed in the “Hobby of Kings”—what to look for in a coin; mints and mintmarks; what makes a coin valuable; getting the most out of coin clubs, shows, and exhibits; how to find a trustworthy coin dealer; where to buy coins; how to care for and store your coins; understanding how coins are graded; the ins and outs of both buying and selling; commemorative coins; U.S. circulating coinage from 1793 to date, plus other coin-related collectibles

Limited Offer from Greysheet

Limited Offer from Greysheet.com