Bluesheet: DID WE SEE THE MARKET BOTTOM IN 2016?

As we wrote in the final Bluesheet of 2016, many market participants are looking forward to 2017 with a positive outlook. According to the Professional Numismatist’s Guild, the total auction prices realized for the year came in at a bit under $342 million. This marks the third consecutive year the total auction prices realized has declined year over year. In 2014 the total was $536 million and in 2015 the total was $439 million. Much of this decrease can be explained by the presence of major collections sold in previous years: Newman, Gardner, Partrick, and Pogue. The PNG estimates auction and direct sales of U.S. rare coins at $4 billion, which importantly, does not include bullion and sales of the United States Mint. Looking back at the 2015 numbers, the Mint itself was responsible for more than $2.5 billion of bullion and collectible coin sales. When factoring in U.S. and world paper money and bullion from other sources besides the Mint, the numismatic business in the U.S. easily approaches $8 billion.

Should we be concerned with consecutive years of total auction volume decreases? As stated above, some of the declines can be explained by the lack of major, landmark collections being sold this year. However, there is something to say about possible “auction fatigue” and the desire of collectors to sell directly to a dealer via private treaty or consignment. Dealers who have built up trust with a collector over time by dealing fairly with them are much more likely to get a chance to buy the collection before the decision is made to consign to public auction. The sheer number of auction sales that occur each year may cause concern on the part of the consignor that their coins might be overlooked in the vast volume of coins being sold. However, the marketing and publicity from the major auction houses is unrivaled.

By our analysis, it is very possible to conclude that 2016 was the low point in a market cycle and total auction prices will be higher in 2017. Furthermore, it is fair to say that the biggest and most important coin collections will continue to be sold at public auction, for everyone’s benefit.

THIS WEEK’S MARKET

Classic Commems (Silver & Gold):

Both silver and gold commems witnessed a fair amount of sight-unseen bid activity this week. More pluses than minuses.

Morgan Dollars:

A few bidders have retreated on slightly-better dates.

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to The Greysheet for the industry's most respected pricing and to read more articles just like this.

Source: CDN Publishing

Related Stories (powered by Greysheet News)

View all news

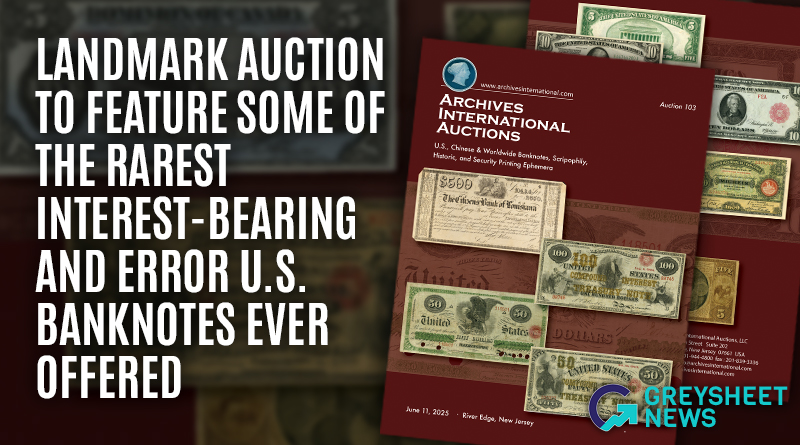

This sale presents an unprecedented opportunity for collectors to acquire museum-worthy examples from the nation's most pivotal monetary periods.

This relatively strong performance falls right between the prior two editions of this sale.

Greysheet Market Reports are the best way to stay current way on rare coin and paper money market info.

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments