BLUESHEET: WHAT WILL 2018 BRING IN NUMISMATICS?

As we kick off a new calendar year it’s a fun exercise to think of what changes might occur in the new year. The previous year ended with mixed results across the board for dealers. Depending on who you ask, some folks had a great year, and others would argue the opposite. The challenges faced in 2017 included a lukewarm bullion market which buyers out of coin shops; a strong stock market which kept collectors from putting money into fixed (non-performing) collectibles; and a gradual decline in certified coins among oft-traded issues like Morgan dollars. Solid performances in 2017 were found in key date coins, premium quality coins, monster toning, old-holders, and CAC-stickered material did well. I think the best summary of the positives that one can derive is that this group of coins is the scarcest subset of material on the market in terms of sheer quantity, and demand for such items will always be strongest.

With that said, many dealers feel that prices on more readily-available material like the slightly better dates in 20th century gold, Morgan & Peace dollars, classic commems, have finally gotten to a point where there is really good value here. As a Bluesheet reader, you are already familiar with our reporting of the extremes between sight-unseen values and CAC pricing. For many issues, there is a wide range between for the selective buyer to pick and choose and a savvy negotiator can find some real deals in this market. Collectors and investors should use this opportunity to assemble collections (sets) of coins that take some time to do right, and at the right price. For example, an MS63-65 Walker set at current levels has never been more accessible, yet few come to market intact, and a nicely-matched collection could yield a nice ROI for the buyer.

Additionally, many stock-market players are deeply concerned that the market is getting top heavy. Now is a great time for collectors to shift some of their assets from this peaked market and take some of those chips off the table, while enjoying a great coin collection at the same time.

Bitcoin was all the rage in 2017 with values shooting off the chart. This “commodity” appears to be a major bubble in the making, and once it bursts, the fallout could be ugly. The beneficiary of a bursting bitcoin will be gold—the truly universal commodity. Gold has been wallowing in the mid-1200’s to low 1300’s all year. While unexciting for investors, there has been tremendous strength in this base and we could easily see a big jump in 2018. Now that would be reason to cheer in December 2018!

From all of us at CDN Publishing, we wish you a happy & prosperous new year to you and your families!

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to The Greysheet for the industry's most respected pricing and to read more articles just like this.

Source: CDN Publishing

Related Stories (powered by Greysheet News)

View all news

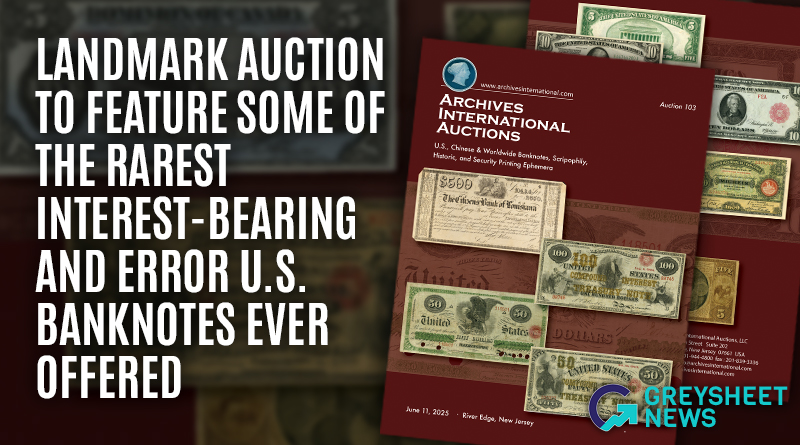

This sale presents an unprecedented opportunity for collectors to acquire museum-worthy examples from the nation's most pivotal monetary periods.

This relatively strong performance falls right between the prior two editions of this sale.

Greysheet Market Reports are the best way to stay current way on rare coin and paper money market info.

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments