Editors Message (CPG Market Review April 2021)

One of the major themes thus far in 2021 is how on fire the collectibles space has been.

One of the major themes thus far in 2021 is how on fire the collectibles space has been. Whether in mainstream media publications or industry-specific ones, much more attention than average has been paid to the prices being paid for rare objects. For coins, the $9.36 million sale of the Brasher Doubloon generated many news stories (for a great analysis of this sale check out the April issue of the Monthly Greysheet). More recently came the news that the unique-in-private-hands 1933 Saint-Gaudens will be auctioned in June. The sale of this coin, which by all measures should set an all-time new record, will generate much buzz in the media. As coin lovers, this is all good news. But what are some of the major trends of the current market? First, it is clear that rarities are enjoying a new wave of buyers who are seeking the best material. Although “rarities” can be a nebulous term, in this case we are talking coins that are $100,000 or more. While there are not many collectors who play at this level, there is a much smaller pool of coins that qualify, so if even a few new buyers come in prices can jump, and this is what has happened. Next, across nearly all levels of coins the wholesale prices have risen 10 to 15%. Many dealers are willing to pay more for coins and are even being slightly less picky to keep their inventory numbers up. Because of the continued lack of in-person coin shows, the competition at auction is tough as ever, with dealers and collectors competing for the same material. This begs the question whether it is time to sell. There has been no shortage of both major and minor collections being consigned to auction or sold via private treaty brokered by a dealer, but there is room for more. Selling decisions are, of course, heavily dependent on the individual’s life situation. For a focused, specialized collection of U.S. coins that has been held for greater than five years, the present is the best selling opportunity since 2008. Something to consider is that the auction consignment and selling process can be time consuming, and the market can change directions in the interim. In some cases, collectors should explore selling directly to a trusted dealer in addition to exploring the auction route.

Another exciting piece of news to share is that we have partnered with the American Numismatic Association to support the eLearning Academy. CDN Publishing/Greysheet has always been the leading data provider to the rare coin market and over the years has published innumerable educational articles, so this partnership is a natural. For those not familiar, the ANA eLearning Academy is an online collection of courses that collectors can utilize to further their knowledge. The courses cover a wide swath of both American and International numismatics. There are 20 to 24 new courses added each quarter, and there are already nine courses announced for April. to learn more, please visit https://info.money.org/elearning.

Sincerely,

Patrick Ian Perez,

CDN Editor

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

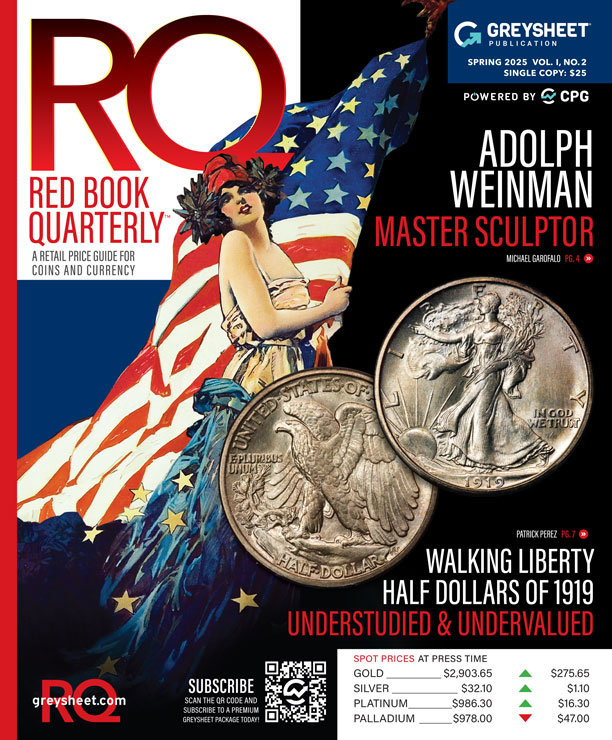

Subscribe to RQ Red Book Quarterly for the industry's most respected pricing and to read more articles just like this.

Author: Patrick Ian Perez

Patrick Ian Perez began as a full time numismatist in June of 2008. For six years he owned and operated a retail brick and mortar coin shop in southern California. He joined the Coin Dealer Newsletter in August of 2014 and was promoted to Editor in June 2015. In the ensuing years with CDN, he became Vice President of Content & Development, managing the monthly periodical publications and data and pricing projects. With the acquisition of Whitman Brands, Patrick now serves as Chief Publishing Officer, helping our great team to produce hobby-leading resources.

In addition to United States coins, his numismatic interests include world paper money, world coins with an emphasis on Mexico and Germany, and numismatic literature. Patrick has been also published in the Journal of the International Bank Note Society (IBNS).

Related Stories (powered by Greysheet News)

View all news

Dramatic swings both ways, but mostly in the upward direction, have commanded the headlines.

There was no shortage of market madness towards the end of March and into April, from both a macro equity point of view and in precious metals.

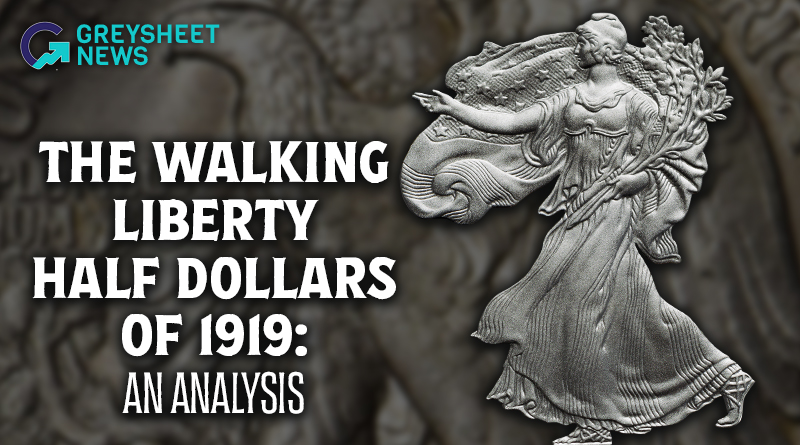

Although the three 1921 Walkers boast the lowest collective mintages in the series, the 1919 dated coins are not too far behind.

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments