5 Coin Collecting Investment Mistakes to Avoid

Avoid These Common Mistakes to Make Money in Coins

Many people make a tidy profit from their coin collection when it comes time to sell. Avoid these top five common mistakes, and you too can make money investing in coins.

1. If it's Too Good to be True...

Nobody wants to overpay for a coin. Most coin collectors are looking for a good deal whenever they buy a coin. There are many places to buy coins besides a coin dealer or on the Internet. I have seen coins in garage sales, flea markets, small shops in small towns, consignment shops, and various other places. Sometimes I look at the prices and think, "Wow! What are they thinking?!?!" Other times I say to myself, "If it's too good to be true…" and walk away. However, on a few occasions, I have bought a coin or two at these places, knowing full well it could be counterfeit, cleaned, or have hidden damage. My rule of thumb is, "I don't spend more money than I'm afraid to lose. A few times, I came out on top, but I ended up throwing away my money most of the time. I chalk it up to another lesson in the school of hard knocks.

2. Following the Latest "Hot Tip"

Just like stocks and bonds, there are a lot of people that will tell you what's going to be the next hot coin tomorrow, next month, next year, or next decade. If it was that easy to predict the future, these people would already be rich and not have to make money by giving numismatic advice. This is especially true if the advice is coming from a person trying to sell you coins on television or over the telephone.

Another risky area of coin collecting is flipping. Flipping is buying a low mintage coin directly from the mint and then immediately selling it for a quick profit. There are many people that make money from doing this. However, if you miss the opportunity to buy the coin or the market becomes flooded very quickly, you may actually lose money.

Many people are willing to give you advice on which is the next coin to buy. If the advice comes from a trusted source, such as a coin dealer or coin collector you have known for decades, you may want to consider it. However, if it is too good to be true, it probably is.

3. Certified Coins from Self-Slabbers

Most people consider the top-tier coin authentication and certification services to be Professional Coin Grading Service (PCGS) and Numismatic Guaranty Corporation (NGC). The second tier is generally considered to be ANACS and Independent Coin Graders (ICG). However, anyone can buy a machine to encapsulate coins in special plastic holders and slap a label on them. There is one firm that states that they specialize in MS-70 and Proof-70 coins. In other words, every coin that is submitted to them gets put into a slab with one of these two grades. That does not mean these coins actual earn these grades. Most coin dealers would consider them to be over graded and would not buy nor sell them in their shop. Remember, coin grading is an opinion and you should depend upon the opinions of experts that work for the top-tier coin grading companies.

4. Foreign Coins from Small/Unknown Countries

It is the sovereign right of any country to issue coinage. Some of these small or little-known countries will produce very low mintage coins with popular subjects. Although they will be touted as "rare" because of their low mintage numbers, this does not mean that there is a demand for them, and their value will increase in price over time. There are many other factors that determine the value of a coin . Some of these small countries that issue popular commemorative coins include Liberia, Isle of Man, Marshall Islands, Niue, and Guinea. Also, avoid colorized coins and coins that are plated with precious metals (gold, silver, or platinum).

5. Skip the Research

There is an old adage that says, "Buy the book before the coin." The people that I know who have made the most money in coins were "coin collectors" first and "coin investors" second. Their primary goal was to assemble a quality coin collection and not to make a "quick buck." Just like financial investments, successful coin investors are in it for the long haul. Researching and learning about the coins you collect will give you the knowledge to make sound financial investments in coins. There are no get-rich-quick formulas in the world of coin collecting. However, wise purchases made over a period of time will yield financial benefits in the future.

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to RQ Red Book Quarterly for the industry's most respected pricing and to read more articles just like this.

Author: James M Bucki

Related Stories (powered by Greysheet News)

View all news

A die variety occurs when there is an intentional or unintentional change or variation to the design on the coin die.

There are many reasons people start collecting coins: for fun, profit, even investment. It's best to learn the basics before you jump in too quickly.

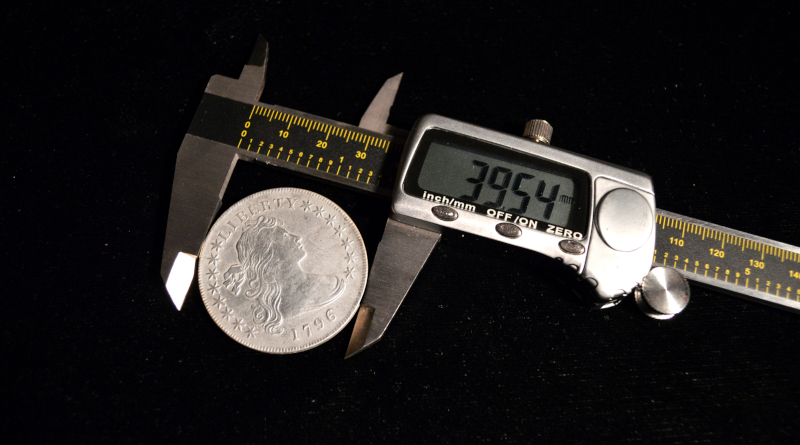

Detecting counterfeit coins is a science that requires skill and experience to perfect.

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments