Is It Practical to Buy CAC-Approved Coins Without Paying Usual CAC Premiums?

In auctions and public Internet sales, CAC approved coins realize large premiums on average, but not in every instance.

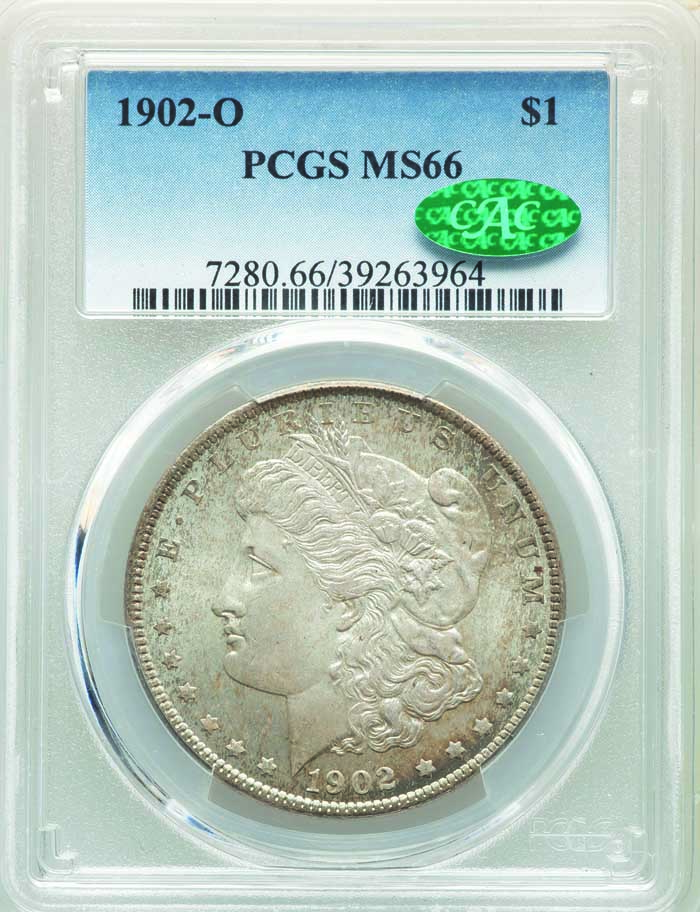

1902-O Morgan dollar graded PCGS MS66 CAC (Images courtesy of Heritage Auctions, HA.com.)

In auctions and public Internet sales, CAC approved coins realize large premiums on average, but not in every instance. An interesting question is whether it makes sense for collectors who seek CAC approved coins to attempt to purchase CAC approved coins for little or no premium over coins that have received the same numerical grade from PCGS or NGC and have not been CAC approved. In other words, does it make sense to spend time and expend effort to try to buy CAC approved coins without paying usual CAC premiums?

For rare or at least somewhat scarce CAC approved coins in auctions or public internet sales, premiums in the 15% to 40% range are frequently realized. Fairly often, premiums of 50% to 100% are paid.

In press releases issued each month by CAC, there are examples of premiums realized by CAC approved coins. John Albanese oversees the wording, format and final selections in the respective list in each release. I do the underlying research.

I have spent decades researching auction prices realized in general, beginning long before CAC was founded in 2007. Indeed, no one has had published more coin auction reviews than I have.

Most of my auction reviews feature analyses of prices realized and comments about specific coins that I examined. So far in 2020 in the Greysheet Monthly, I have discussed the auctions of the Rollo Fox set of Saints, the Doug Bird Collection of large cents, and remaining coins in the Pogue Family Collection. Over the course of my career, I have contributed more than 100 auction reviews, which typically include my opinions, to eight different numismatic publications. Nonetheless, I am not expressing my opinions here.

I am raising an issue regarding buying strategies and CAC premiums. Some collectors have formed erroneous impressions that CAC premiums are always realized or that auction prices automatically turn out to be market prices!

There is a limit to the number of hours that collectors and dealers can practically spend searching for and bidding upon coins in auctions and public Internet sales. Each buyer will participate in a limited number of instances and each human mind can actively keep track of a limited amount of information. Dealers just do not have time to carefully consider all of the coins being publicly offered, not even all of the coins pertaining their respective specialties. Collector participation varies and is unpredictable.

A price realized for any one coin in an auction may turn out to be above-retail, mid-retail, around the wholesale-retail border, a top wholesale price, or a middle-wholesale price. It is rare for an auction result to be a low-wholesale price. CPG® prices are estimates of retail levels.

I interpret Greysheet “Bid” prices to be top wholesale prices, amounts that dealers who really want a particular item are willing to pay. Many wholesalers pay less than Greysheet Bid prices in private transactions with the idea of selling for Greysheet prices or other prices in the pertinent upper-wholesale ranges.

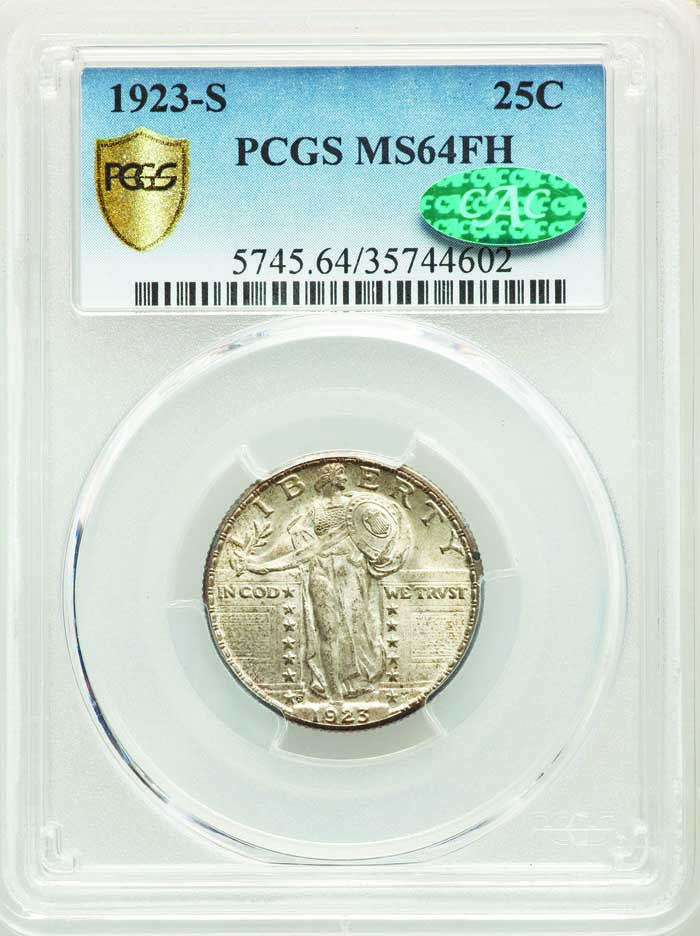

1923-S Standing Liberty quarter graded PCGS MS64 Full Head (FH) and stickered by CAC.

A wholesale price for a CAC approved coin may be less or around the same as a retail price for a non-CAC coin of the same date and type that received the same numerical grade from the same grading service. There is no simple formula for drawing conclusions about prices realized. To analyze auction results, there is a need to have an understanding of the current market environment plus much knowledge about the coin business in general, and an ability to interpret the coins themselves.

Examples provided in this discussion demonstrate that not all CAC approved coins bring premiums in auctions over non-CAC coins that received the same respective certifications. It should be remembered, though, that CAC approved coins bring substantial premiums in a majority of auctions and public Internet sales.

One objective here is to stimulate thought about coins and auctions. Another is to help inform buyers while emphasizing that is wrong to simply think of auction results as “market prices.” Examples are illustrations, for general educational purposes. There is not here a recommendation for or against any individual coin.

On March 20, Stack’s Bowers auctioned a CAC approved, NGC graded AU55 1874-CC double eagle for $5,760, which was certainly a wholesale price. In April 2020, Heritage auctioned an NGC graded AU55 1874-CC double eagle, without a CAC sticker, for $5,772. On June 1, the Goldbergs auctioned a different NGC graded AU55 1874-CC double eagle, without a CAC sticker, for $6,000.

On June 14, 2020, GreatCollections sold a CAC approved, PCGS graded MS64 1930-S Buffalo nickel for $154.12. On May 5, 2020, Heritage sold a PCGS graded MS64 1930-S Buffalo nickel, without a CAC sticker, for more, $162. On February 8, 2020, Heritage sold a different PCGS graded MS64 1930-S Buffalo nickel, without a CAC sticker, also for $162.

According to the August 2020 issue of The CAC Rare Coin Market Review, the CPG® CAC retail value estimate for a MS64 grade 1930-S nickel was $221. On August 5, the online Greysheet Bid for a CAC approved MS64 grade 1930-S nickel was $170. Therefore, the CAC approved coin that GreatCollections sold on June 14 may have been a really good deal that both collectors and dealers missed.

On June 14, 2020, GreatCollections sold a CAC approved, PCGS graded MS64 1908 dime for $163.37. On April 21, Heritage sold a PCGS graded MS64 1908 dime, without a CAC sticker, for $162, almost the same price.

On June 18, 2020, Stack’s Bowers auctioned a CAC approved, PCGS graded MS64 1919-S Walking Liberty half dollar for $10,200. On March 19, Stack’s Bowers auctioned a PCGS graded MS64 1919-S Walking Liberty half dollar, without a CAC sticker, for $11,400.

On July 15, 2020, Heritage sold a CAC approved, PCGS graded MS66 1902-O Morgan silver dollar for $312. On July 26, Great Collections sold a different CAC approved, PCGS graded MS66 1902-O Morgan silver dollar for $956.25.

On July 12, GreatCollections sold a PCGS graded MS66 1902-O Morgan, without a CAC sticker, for $478.12. One week earlier, on July 5, GreatCollections sold a different PCGS graded MS66 1902-O Morgan, without a CAC sticker, for $355.50. Both these non-CAC coins are very much white, with some colorful toning, mostly in the outer fields. Why did each bring more than a just mentioned CAC approved, MS66 1902-O Morgan, which brought just $312 on July15?

On July 29, Stack’s Bower sold a CAC approved, PCGS graded MS65 1897-S Morgan silver dollar for $480. On June 24, Heritage sold a PCGS graded MS65 1897-S Morgan, without a CAC sticker, for $528. Greysheet and CPG ® value estimates suggest that the $528 paid on June 24 was clearly a retail price and the $480 paid on July 29 was in between wholesale and retail levels. I do not have a reason to think otherwise.

On July 29, Stack’s Bowers sold a CAC approved, NGC graded MS65 1936-S Bay Bridge commemorative half dollar for $168. In an online sale devoted to commemoratives on May 15, Heritage sold an NGC graded MS65 1936-S Bay Bridge commemorative half dollar, without a CAC sticker, for $198.

On August 3, Heritage auctioned a CAC approved, PCGS certified MS64FH 1923-S quarter for $3,720. “FH” refers to a Full Head designation by PCGS. In February 2020, Heritage auctioned a PCGS certified MS64FH 1923-S, without a CAC sticker, for $4,080. In the August 2020 Greysheet Monthly, the bid for this coin is $3,750. In the August 2020 issue of The CAC Rare Coin Review, the CPG®-CAC retail estimate is $4,690. The CAC approved 1923-S quarter that was auctioned on August 3 brought an upper wholesale price, less than a mid-retail price for a non-CAC, PCGS certified MS64FH 1923-S quarter.

A short list of examples does not answer the central question in this discussion; is it practical to buy CAC approved coins without paying significant premiums? Yes and no; here and there, a collector will find an opportunity to do so. It would not be practical, however, to complete a noteworthy set or to build a large collection by adhering to a strategy of always buying CAC approved coins without paying CAC-level prices. The reality is that CAC approved coins will usually sell for significant premiums.

Also, no service is perfect. No grader or finalizer will ever “bat one thousand.” It does not make sense to draw conclusions about the quality of a coin without precisely examining its physical characteristics with magnification, in a darkened room. Grading services provide opinions and certifications lessen risk. Any certified grade, however, should not be taken too seriously. It is logical to think about how each specific coin would be or should be interpreted outside of any holder.

Copyright ©2020 Greg Reynolds

Insightful10@gmail.com

Images courtesy of Heritage Auctions, HA.com

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to CAC Rare Coin Market Review for the industry's most respected pricing and to read more articles just like this.

Source: Greg Reynolds

Related Stories (powered by Greysheet News)

View all news

The Lusk set of Draped Bust quarters brought strong results.

The 1889-CC is the second scarcest business strike in the series.

Just six coins are required for a set of true Nova Constellatio Coppers, and the coins selected need not be very expensive.

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments