Retail Day-Traders Turn their Sights to Silver

At the market open on Sunday, the spot silver market spiked, a move that was largely anticipated as silver was touted as the next target of the retail day-trading masses. We could be in for a wild ride for a few weeks.

At the market open Sunday, January 31, the spot silver market spiked, a move that was largely anticipated as silver was touted as the next target of the retail day-trading masses.

Last Wednesday, prompted by the Reddit group WallStreetBets (now being referred to in the media as “WSB”) massive retail buying commenced in a small group of stocks including Gamestop (GME) and AMC Entertainment Holdings (AMC). This group of stocks had the largest amount of short interest (SI) in the market, meaning there were significant options positions betting the stocks would drop in price, even though they were already inexpensive. This market action is known as a short squeeze. A few things to point out here.

First, a short squeeze is nothing new, it has happened many times. Just look up the story of Volkswagen stock in 2008. Second, numerous market analysts have pointed out, as long as nine to ten years ago, that taking a long position in a basket of equally weighted “most shorted” stocks is profitable. And it surely has been. This short squeeze prompted the unprecedented action of brokerages (specifically zero-commission small money brokerages such as Robinhood) limiting trading in a number of stocks, thereby limiting price action. The reasoning behind this activist buying was ostensibly to punish those who were shorting these stocks.

Where does silver come in?

Starting overnight into Friday morning, chatter began to appear that the silver market, primarily in the form of the exchange traded fund (ETF) SLV is the next target of the WSB crowd. Anyone who has followed the silver market over the past decade-plus will be fully aware of its price manipulation via the paper market. JP Morgan and other large institutions have paid numerous fines to regulators in that time for market improprieties. The same reasoning is applied: those that are short the silver market should be financially punished for suppressing the silver market and preventing “true value.”

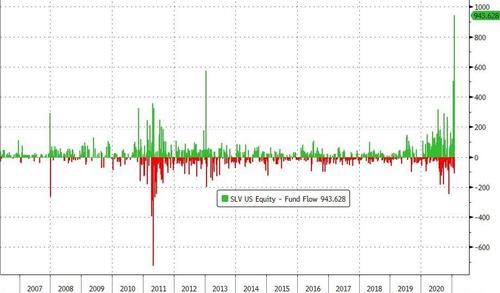

Chart 1

On Friday alone, $943.6 million poured into SLV from traders. (Chart 1). It is important to understand how SLV works. The proper name is IShares Silver Trust. The trust is supposed to hold one ounce of physical silver per share issued. Custodians of the trust hold the physical silver in vaults in New York and London. At the end of each day silver is transferred in or out of the trust based on the net position of buys versus sells. Of course, with the huge volumes involved actual silver is not moved, it simply changes in the account books of the custodians. Nonetheless, the trust must own the specified amount of physical silver.

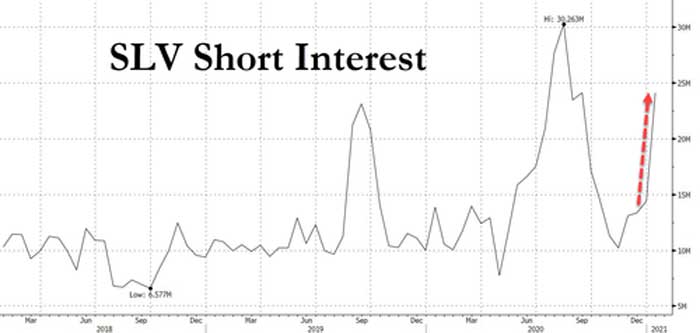

Chart 2

As of the market close on Friday, total assets of SLV sat at $16.49 billion. Also, since late December short interest has sharply increased in SLV (Chart 2). The risk that needs to be understood by buyers of SLV is that it is a product; at any time Blackrock can liquidate the trust and pay shareholders cash at the closing share price on the day of liquidation. This happens more often than people realize with ETFs and ETNs when they are no longer profitable for their issuers. It happened to a major oil ETF when that market went crazy in mid-2020.

APMEX halted silver sales over the weekend due to unprecedented demand amid an uncertain supply.

What about the physical silver market? Clearly large inflows to SLV necessitate buying physical silver on the open market, thus driving up the spot price. Second, those that are short actual silver futures contracts on the COMEX (naked shorts) must cover their positions, and in the event the counterparty demands delivery at options expiration, they must go out into the open market and pay any price to get the silver. It is widely known that there are significantly more paper ounces in contracts than there are physical ounces in the COMEX warehouses. This does not inhibit market function because nearly all contracts are settled in cash or rolled over. However, it has been predicted – for some time – that demand for delivery of contracts will increase, thus severely constricting the supply. The problem is that COMEX, as the regulator, can simply change the rules on how contracts are settled, and in fact in the past have made very subtle changes to this end. Thus, the only true way to own silver is to buy physical bullion in the form of bars and coins. We have seen in the past, and are seeing right now, even incremental increases in demand for silver bullion creates virtual overnight shortages. On Sunday multiple major bullion dealers posted messages on their websites that they are not taking orders until the markets open to limit unhedged exposure. The reality is that there is a much smaller amount of silver available than people realize; the market cap of physical silver is remarkably small compared to other assets. The silver shortage did not happen overnight; there was never that much to begin with. Thus far, there have not been corresponding moves in gold and platinum. To conclude, we have a massive confluence of events in the silver market:

A) people who already own silver and have for many years will not be selling (taking profits) this time because they do not view precious metals in that way. They view it as hard currency, not an investment. There is a fundamental difference here.

B) a huge population of young people are being exposed to precious metals for the first time, learning how they work and how its price is established, creating demand.

C) institutional traders realizing they will need to somehow cover their short positions in the event spot silver goes parabolic.

D) a major shortage of physical silver bullion products to be had on the market, sending premiums skyrocketing.

One this is certain... It will be an interesting couple of weeks!

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to The Greysheet for the industry's most respected pricing and to read more articles just like this.

Author: Patrick Ian Perez

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments