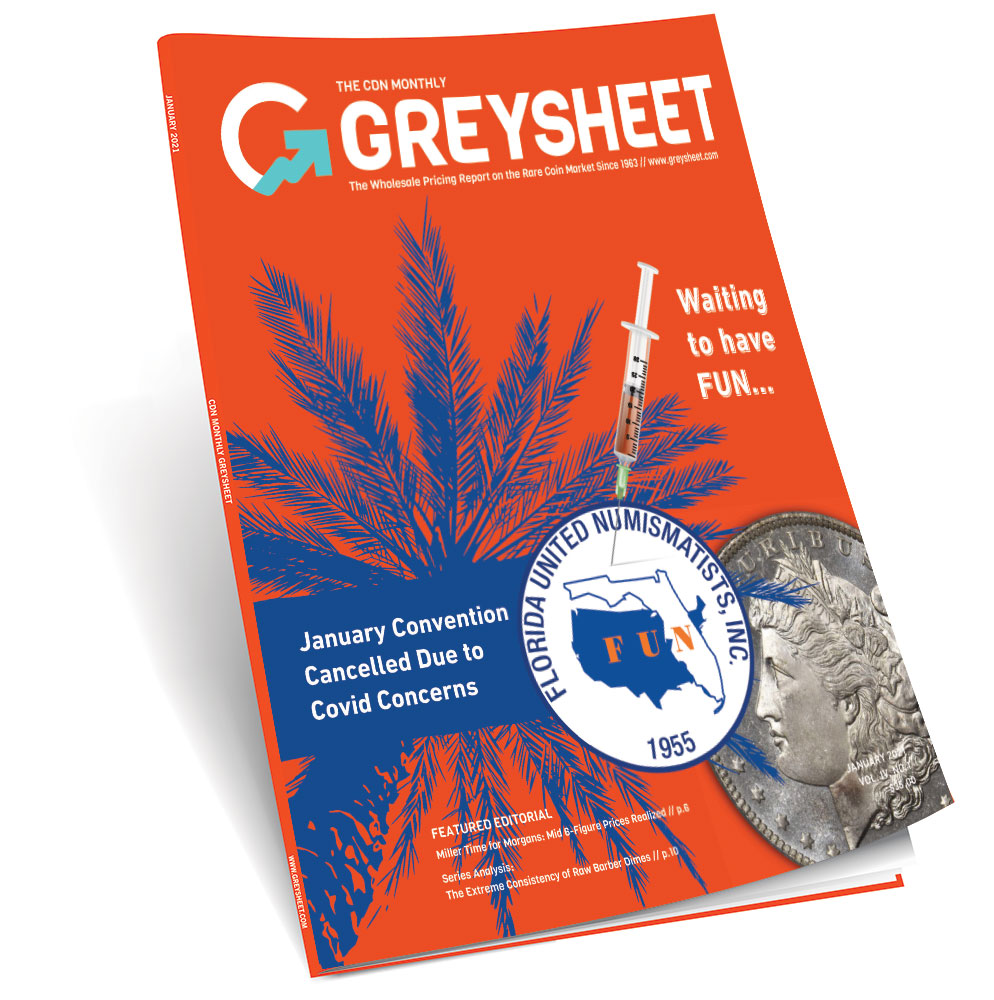

The January Greysheet Publishers Report: FUN Cancelled, Market Predictions, PCGS Parent Company to Sell and More

In the January 2021 issue, Greysheet Publisher John Feigenbaum looks forward to the coming year. The coin business has been remarkably resilient during COVID and the end of the coin-show draught is in sight. In other news, the board of PCGS' parent company has agreed to sell CLCT for an astounding $700 million.

Happy New Year to all of our readers! I don’t think I’m alone in my hopes that 2021 is a better year than 2020. Financially speaking, 2020 was mixed depending on who you asked. Some companies survived the initial COVID nightmare better than others, and we all know that some industries were simply crushed by the shutdowns. In the coin business, show promoters were hit especially hard as they were forced to cancel most of their schedule, a trend that continues into at least the first quarter of 2021.

Just as we were headed to the printers with this magazine we received word from the folks at Florida United Numismatists that the January FUN show would be canceled. The organizers did their best to make the event happen, but in the end I believe they made the right decision. Most of the national dealers I spoke with told me they would not be able to attend in the midst of the pandemic.

The good news is a vaccine is right around the corner and hopefully will be effective in time for shows in late Spring, including the Summer FUN show. Everyone I speak to is anxious to get to a coin show, but safety comes first. We will definitely be back in the sunshine state in 2022!

In other news this month... PCGS’ parent company, Collectors Universe, announced the sale of their company on November 30 to a financial group led by Cohen Private Ventures and D1 Capital Partners for around $700 million. This jaw-dropping amount of approximately $75 per share represents a significant premium over the share price of $15-20 that the stock traded at prior to the COVID shutdowns in early 2020. Dealers I’ve spoken to are still in a daze over the news and many in the numismatic side are left wondering about the future of PCGS, as the new owners have made the acquisition largely on the basis of the sports card grading (PSA) division. Nobody is certain if there will be any material change at PCGS in management, pricing, or otherwise. For that matter, will PCGS or other non-PSA assets be sold off? Time will tell and the press releases suggest the sale will be completed in the first quarter of this year. Read my analysis of the proposed CLCT sale here.

As we look forward to 2021 here at CDN, we are excited about the possibilities for growing within the hobby of numismatics. We love rare coins and paper money, and we really appreciate the loyal readership of our subscribers. By now, I hope you have been able to log in and visit our web site as we have completely transformed it over the past few months. We are proud to offer an unprecedented amount of pricing, research, news and events information. We also have a new app for your smartphone which will hopefully be ready for download by the time you read this article.

As the world, and economy slowly emerge from the COVID nightmare of 2020, we look forward to seeing everyone in person again at shows and live auctions. The rare coin market has sustained incredibly well over this period. I would add that prices did not go crazy up, or down, this past year. The rare coin market is quite mature and resilient, and I’m especially proud of how the people of the coin business persevered during the toughest of times.

From all of us at CDN, we wish you and your families the best in 2021.

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to The Greysheet for the industry's most respected pricing and to read more articles just like this.

Author: John Feigenbaum

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments