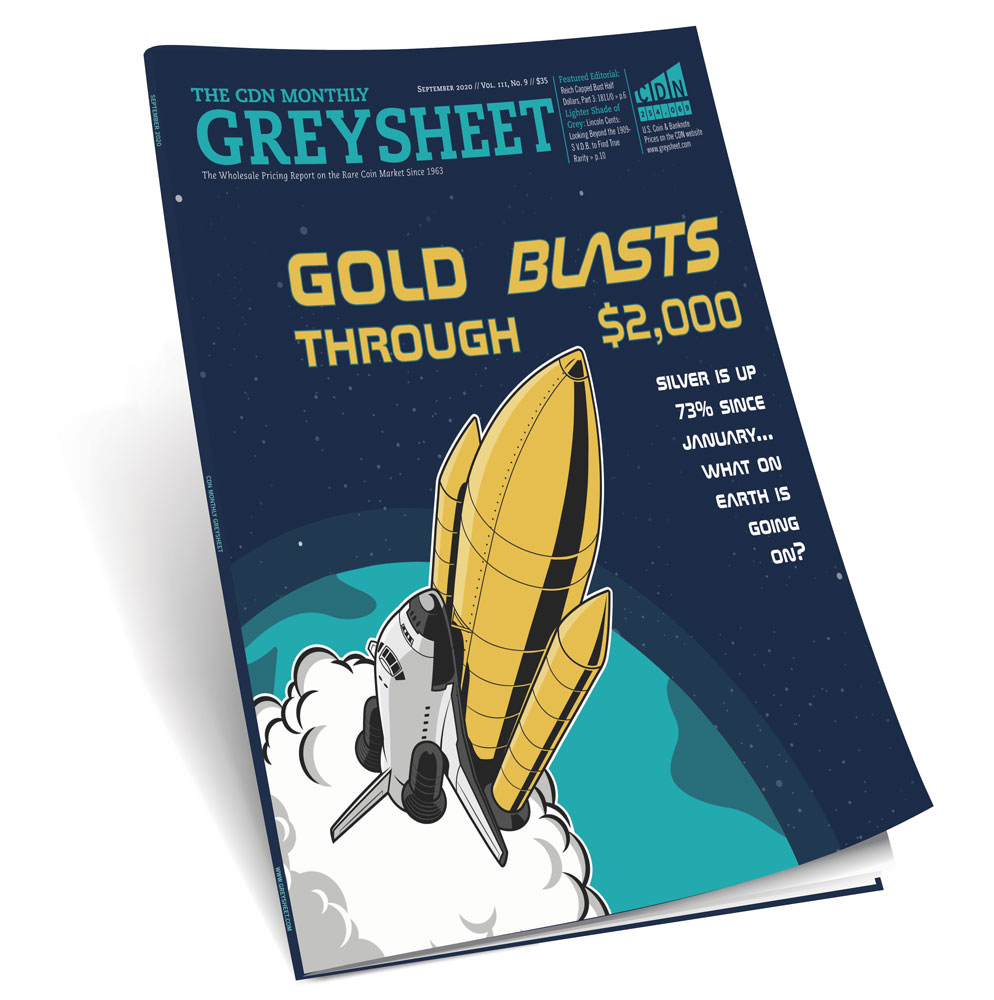

Activity across the market (September 2020 Greysheet)

The Greysheet is an uncommon item in that it is aimed at numismatic professionals but is available and recognized by the wider public.

To say keeping up with the tremendous moves in the gold and silver spot prices has been a mad scramble would be an understatement. It has certainly been invigorating, and the exuberance in the precious metals market has generated tremendous momentum in the rare coin business. One of the most interesting aspects of the market is the price action in generic U.S. gold. When the gold spot price was depressed for an extended period there was a significant glut in the generic gold supply, sending premiums to all-time lows.

In the past, the lower the gold spot price went, the larger the spread would be, and this was always the selling point of U.S. classic gold—that it would hold its value better than regular bullion. The over-supply that happened from 2018 to just a few months ago changed that. However, this inverted very rapidly when gold started rising, and the same large dealers who were selling many coins at or below spot were now buying at significant premiums over spot. This signals a surge in retail buying, which is not surprising; the public has the tendency to buy high and sell low. As always, an important question is whether the huge influx of cash and buyers into the industry will leak into strictly numismatic coins. There is little doubt that there has been an uptick in collectibles in general; a risk is that rare coins get left behind among the many other collectible fields.

Certainly, rare coins will always be valuable; the question for buyers is how valuable. This is perhaps the most important factor for collectors who have—and plan to continue to—allocate substantial resources to purchasing rare coins. It is true that pride of ownership and completing a set are other factors, among others, that can be as important as price paid, but the movement of the rare coin market over the next four months will be enlightening and will yield some signs as to the future of the market. As the prospects for real inflation increase, this could place upward pressure on all rare coin prices.

Another aspect to consider is when—and what—to sell into a surging market. Morgan dollars are a good example here. Dealer buy prices for common and some slightly better dates have jumped with the silver price, and many coins in MS63, MS64, and MS65 are at highs not seen in several years. Those with substantial holdings of silver dollars who bought the lows can now sell at a nice profit. This holds true in other series as well, including Silver Eagles and proof Gold Eagles. Rebalancing a rare coin portfolio using profits from one area to buy choice pieces in another that represent good value is a strong possibility in times like these.

One aspect I always like to remind readers during times of intense market activity is that those without extensive experience should be making buying and selling decisions in consultation with a professional dealer. The genesis of the Monthly Greysheet, many years ago, was the Coin Dealer Newsletter. The operative word in that title is dealer. The Greysheet is an uncommon item in that it is aimed at numismatic professionals but is available and recognized by the wider public. There are many professional publications out there that are either inaccessible or very expensive. If you want to delve deeper in the fields of economics, art or options trading for example, there are numerous sources, some of which are obscure and filled with technical jargon. The information contained in these pages, while accessible, should be read with a knowledgeable set of eyes. As we have seen with some recent press releases, any time a market gets into the spotlight there will be people who try to take advantage of the uninformed.

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to The Greysheet for the industry's most respected pricing and to read more articles just like this.

Author: Patrick Ian Perez

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments