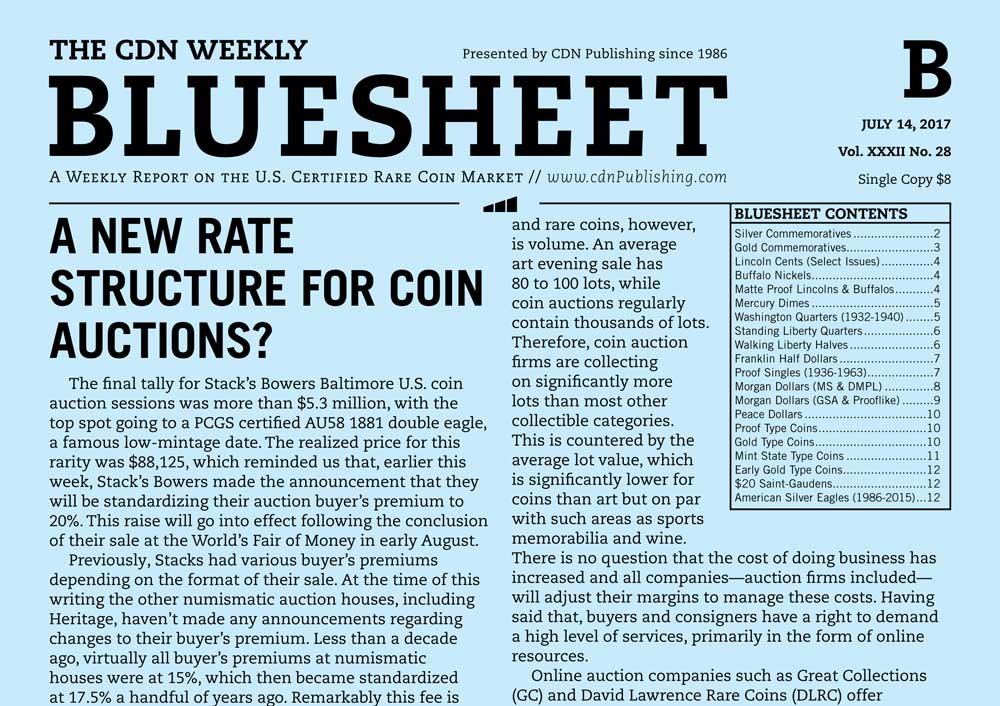

The final tally for Stack’s Bowers Baltimore U.S. coin auction sessions was more than $5.3 million, with the top spot going to a PCGS certified AU58 1881 double eagle, a famous low-mintage date. The realized price for this rarity was $88,125, which reminded us that, earlier this week, Stack’s Bowers made the announcement that they will be standardizing their auction buyer’s premium to 20%. This raise will go into effect following the conclusion of their sale at the World’s Fair of Money in early August.

Previously, Stacks had various buyer’s premiums depending on the format of their sale. At the time of this writing the other numismatic auction houses, including Heritage, haven’t made any announcements regarding changes to their buyer’s premium. Less than a decade ago, virtually all buyer’s premiums at numismatic houses were at 15%, which then became standardized at 17.5% a handful of years ago. Remarkably this fee is low in comparison to many other collectible auctions. At Christie’s Art Department, the buyer’s premium is 25% on the first $100,000, then 20% up to $2,000,000 then 12% on any amount beyond $2,000,000. For a work of art that sells for $1,000,000 hammer the buyer’s premium that must be paid is $205,000. This is more than a 17.5% or 20% flat buyer’s fee. Large sellers of collectible cars, timepieces, and wine auctions have buyer’s premiums in the 22% to 25% range. It is interesting that no coin auction firm currently uses a variable buyer’s premium based on the hammer price of the lot. From our perspective, most coin buyers are not interested in complicated calculations when trying to purchase coins at auctions.

The primary difference between other collectibles and rare coins, however, is volume. An average art evening sale has 80 to 100 lots, while coin auctions regularly contain thousands of lots. Therefore, coin auction firms are collecting on significantly more lots than most other collectible categories. This is countered by the average lot value, which is significantly lower for coins than art but on par with such areas as sports memorabilia and wine. There is no question that the cost of doing business has increased and all companies—auction firms included—will adjust their margins to manage these costs. Having said that, buyers and consigners have a right to demand a high level of services, primarily in the form of online resources.

Online auction companies such as Great Collections (GC) and David Lawrence Rare Coins (DLRC) offer consumers a different, online only, bidding model. GC charges only 10% buyer’s premium ($5 minimum) while DLRC has no buyer’s premium at all. Of course, neither has the expense of printed catalogs or live bidding venues.

The biggest outlier, of course, is eBay. At their founding, eBay was touted as an auction site, and while much of their marketing lately is that of an e-commerce site (such as Amazon), a huge number of items are sold via auction. There is no buyer’s premium for standard listings on eBay, with the sellers responsible for paying the transaction fees. If buyer’s premium continue to increase, will it drive more buyers to zero premium auction sites such as eBay?

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to Monthly Greysheet for the industry's most respected pricing and to read more articles just like this.

Source: CDN Publishing