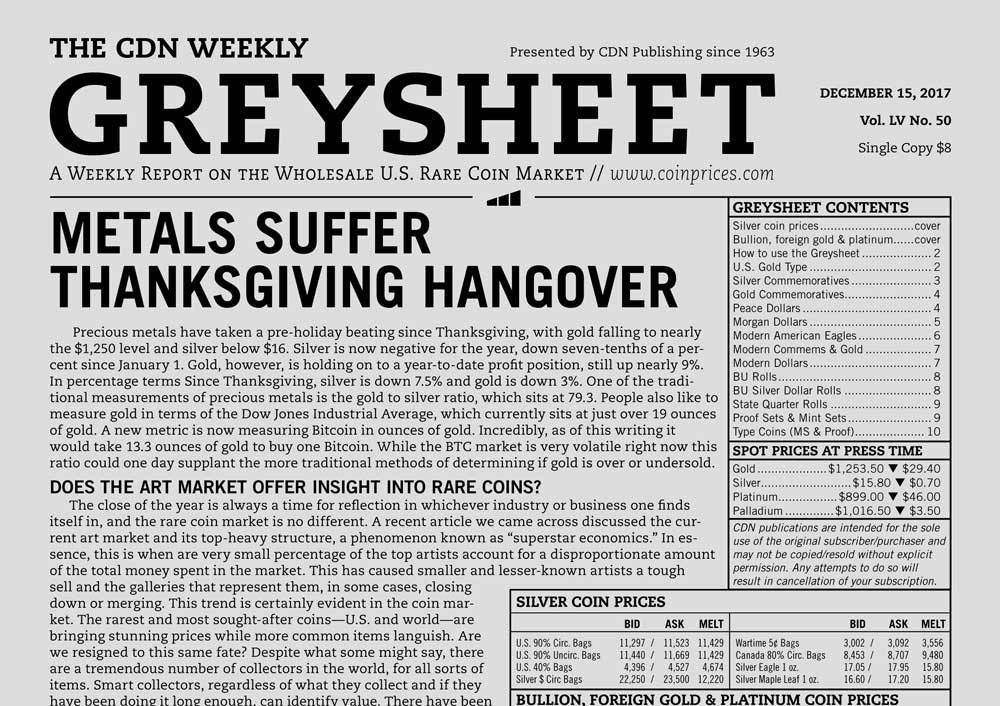

Precious metals have taken a pre-holiday beating since Thanksgiving, with gold falling to nearly the $1,250 level and silver below $16. Silver is now negative for the year, down seven-tenths of a percent since January 1. Gold, however, is holding on to a year-to-date profit position, still up nearly 9%. In percentage terms Since Thanksgiving, silver is down 7.5% and gold is down 3%. One of the traditional measurements of precious metals is the gold to silver ratio, which sits at 79.3. People also like to measure gold in terms of the Dow Jones Industrial Average, which currently sits at just over 19 ounces of gold. A new metric is now measuring Bitcoin in ounces of gold. Incredibly, as of this writing it would take 13.3 ounces of gold to buy one Bitcoin. While the BTC market is very volatile right now this ratio could one day supplant the more traditional methods of determining if gold is over or undersold.

DOES THE ART MARKET OFFER INSIGHT INTO RARE COINS?

The close of the year is always a time for reflection in whichever industry or business one finds itself in, and the rare coin market is no different. A recent article we came across discussed the current art market and its top-heavy structure, a phenomenon known as “superstar economics.” In essence, this is when are very small percentage of the top artists account for a disproportionate amount of the total money spent in the market. This has caused smaller and lesser-known artists a tough sell and the galleries that represent them, in some cases, closing down or merging. This trend is certainly evident in the coin market. The rarest and most sought-after coins—U.S. and world—are bringing stunning prices while more common items languish. Are we resigned to this same fate? Despite what some might say, there are a tremendous number of collectors in the world, for all sorts of items. Smart collectors, regardless of what they collect and if they have been doing it long enough, can identify value. There have been a number of individuals enter our market over the past year for this exact reason—they saw value, and have spent considerable sums. By marketing our hobby and cross-promoting it with other collectibles, there may be a whole pool of new buyers waiting to be found.

THIS WEEK’S MARKET

Gold Type:

Unsurprisingly, the fall of the gold spot price has led to decreases in generic gold coinage, primarily double eagles and eagles. There is some positive activity, however, as Type 3 gold dollars and gem $2½ Liberties are bid higher.

Modern Eagles:

This has been an active segment in recent weeks, as many of the issues in this category are used in promotions and programs during the holiday season. There also may be positioning for the new year on the part of program managers. Proof Silver Eagles are higher again this week despite the decline of the silver spot price, and even though the platinum spot price has suffered as well proof Platinum Eagles are now bid at spot plus $175.

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to Monthly Greysheet for the industry's most respected pricing and to read more articles just like this.

Source: CDN Publishing