Heritage's Bass: Part 1 Coin Auction a Success

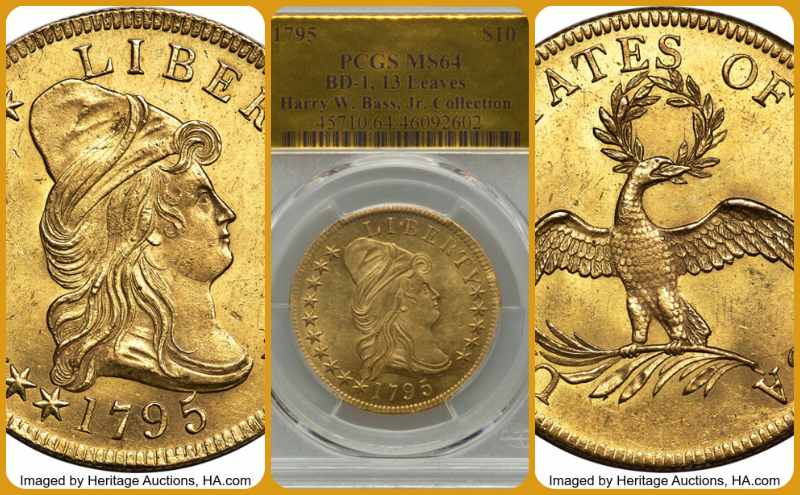

Some of the strongest results in the whole auction were for Bust eagles. The $690,000 result for the MS64 1795 Thirteen Leaves eagle was very strong.

On Thursday, September 29, at a convention center in Long Beach, California, Heritage auctioned the first part of the Harry Bass Core Coin Collection (HBCC). Before the sale, I covered unusual items in this auction. Here I emphasize the overall success of the Bass I sale and then I focus on Bust eagles, which are early U.S. $10 gold coins.

Of the one hundred and six lots, seventy-two were U.S. gold coins. The balance consisted of U.S. patterns and related items. The Bass Collection patterns are really a whole separate topic, which I hope to address in the future. It is not practical to cover every important numismatic item that is auctioned. The thrust here is the success of auctioning gold coins in the Bass I sale.

To comment on the success of an auction, it might be necessary to refer to what is meant by a successful auction. How is a successful auction different from an unsuccessful auction?

In the past, it was common for collectors or curious observers to say or think that an auction went well “because people were paying a lot of money for coins.” Right, if bidders paid amounts that most people would regard as “a lot of money,” does it follow that an auction was successful?

If a coin could reasonably be expected to be wholesaled for $100,000 within a matter of weeks, plausibly in one day, then an auction price between $90,000 and $102,500 for that coin would be very low, not a successful sale at all. An auction result of $150,000 for the same coin would be extremely strong. Depending upon the market dynamics that relate to the particular coin, a medium retail price might very well be around $120,000 and that would be a strong auction result for such a coin. A simplistic example can sometimes be used to communicate an important point.

If a coin could practically be wholesaled within a short to medium amount of time for $10,000, then an auction price of $17,000 would certainly be extremely strong. In the context of analyzing auction results, a price of $17,000 for one coin could be much higher than a price realized of $95,000 for another. An auction that sells coins for greater amounts is not necessarily more successful than an auction that sells different coins for lesser amounts. A $20 million auction might be more successful than a $50 million auction, depending upon the market levels for the respective items that were sold.

The success of an auction is primarily gauged by the relationships between the prices realized and underlying market levels. It is not easy for any auction firm to sell coins for retail prices. There are some collectors who do not participate in auctions. There are others who do so only when they feel like doing so. Moreover, auctions involve snap decisions. It would not make sense for a bidder to call an auction company in the midst of an auction and ask for the sales of individual lots to be delayed for a week so he can have more time to think about his bids.

If a bidder is interested in buying five of ten consecutive lots, and does not buy the first two, he may have just seconds to decide whether to increase his bids on the remaining three lots that were targeted by him or her. Participating in an auction is much different from a collector receiving a coin ‘on approval’ or ‘on memo’ in the mail as the collector can then inspect the coin, take days to decide and perhaps argue about the price.

An important point is that there is no magical formula for generating enough bidding such that auction lots sell for retail level prices. No auction firm can achieve a perfect score in this regard.

In most coin auctions, prices realized tend to be around the wholesale-retail border for each respective coin, usually a little above such a border, which can never be known with certainty anyway. For rare coins and condition rarities of scarce coins, my concept of a wholesale-retail border is largely, though not entirely, consistent with the concept of a Greysheet Bid in CDN publications.

Dealers who are willing to pay Greysheet Bid for a rare coin are willing to pay more than most other relevant dealers for the same coin and usually have a particular reason for paying Greysheet Bid for a particular coin. Some dealers aggressively inventory coins that relate to their specialties. In many instances, a dealer is willing to pay Greysheet Bid for a particular coin because he has one or more prospective collector-buyers in mind and he figures that there is a good chance that he will soon sell it for a substantial profit.

Thus, for clarity in auction reviews of rare coins, it makes sense to think of the wholesale-retail border area, a moderate price, and the corresponding Greysheet Bid as all being similar and consistent enough. Another aspect that relates to the success of an auction is how well an auction fares if there are negative external factors, outside of the coin business, that could potentially harm the results.

Though it was before my time, I have been told that there was a famous auction in New York during the winter of 1984 for which lot viewing and auction sessions were conducted during the week of a brutal snowstorm. Even so, that auction went really well, according to my sources.

I extensively viewed the lots in the Stack’s Bowers Pogue Part VII auction that was conducted on March 20, 2020, during the onset of the COVID-19 pandemic, an environment characterized by fear, uncertainty and panic in some regions of the nation. I provided much evidence to support my conclusion that the pandemic did not have a significant negative impact on the auction; most of the coins in the Pogue VII sale brought prices that were consistent with market levels that prevailed six months earlier. As I concluded that the total prices realized may very plausibly have been the same in October or November 2019, as they were in March 2020, the auction was successful in this way, not damaged by external negative factors.

In both these ways, the selling of coins for retail prices and the surpassing of negative external factors, the Bass I auction was successful. During the month of September 2022, there was alarming negative economic news.

The Bass I sale occurred at the end of a month that was characterized by much turmoil in financial, equity and commodities markets worldwide. After Labor Day, the Dow Jones stock index was at 31,145. By September 29, it fell to 29,226, a drop of about 6.6%. The corresponding numbers for the S&P 500 index were 3,908.19 and 3,640.47 respectively, down 6.85% in a little more than three weeks.

The British pound (GBP) in U.S. dollars decreased from $1.1518 on September 5 to $1.0688 on Sept. 26, a decline of 7.2%. A year earlier, one GBP traded for around $1.35!

Increases in interest rates in the United States over the last few months have also contributed to uncertainty and negative economic outcomes. The economic data presented here were selected to illustrate a point, and are not represented as being scientifically accurate. Everyone is encouraged to refer to appropriate sources for financial data, including The Wall Street Journal.

During September, there were sharp declines in stock indexes, bonds and foreign currencies. It is clear that the month of September was characterized by an especially large amount of uncertainty.

On the U.S. Treasury website, an easy to find page provides Daily Treasury Par Yield Curve Rates. Hopefully, no one will ask me to explain the terms and formulas.

On ten-year U.S. Treasury notes, rates increased from 3.11% on August 30 to 3.76% on September 29. Not only was this a large increase during just one month, it followed a string of increases in recent months. A year earlier, on September 29, 2021, the corresponding rate for ten-year U.S. Treasury notes was 1.55%.

Increases in interest rates sometimes have a negative effect on coin prices, while increases in inflation expectations are likely to have an upward effect on coin prices. It may be impossible to develop a tenable formula to fairly estimate overall effects. An immediate question is whether changes in macroeconomic variables during the month of September substantially affected results in the Bass I sale?

If the Harry Bass Foundation had consigned the HBCC a few months earlier than they did, and this Bass I sale had been conducted in August, the total prices realized would have been a little higher in total than they were on September 29, I hypothesize. Many retail-level results would have been around the same. Nevertheless, I theorize that coin buyers in August were less inhibited and less concerned about economic conditions. It is logical to suggest that there would have been more very strong to extremely strong prices if the Bass I sale was held in August, perhaps including instances of maniacal runaway bidding, as there was for some coins in the post-ANA auctions in August. Many of the rarities in the HBCC are legendary.

From January 2021 to August 2022, there were plenty of cases of runaway bidding for rare U.S. gold coins, leading to prices realized that were way beyond medium retail levels for the respective coins. While it is fair to theorize that there was not as much runaway bidding in the Bass I sale as there would or could have been had economic news been more positive, the strength of the bidding for the vast majority of the coins was very much substantial, including strong bidding for most of the least important or least distinctive of the seventy-two U.S. gold coins in the Bass I sale. Furthermore, many of the more esoteric items realized medium retail prices or more. Indisputably, the Bass I sale was very successful.

Bust Eagles

Some of the strongest results in the whole auction were for Bust eagles (U.S. $10 gold coins). The $690,000 result for the Bass Collection, PCGS graded MS64 1795 Thirteen Leaves eagle was very strong. The few CAC-approved 1795 eagles that have sold or would if offered sell for far more than $690,000 are in a league of their own and this Bass Collection 1795 eagle is not a member. Put differently, the PCGS graded MS64+ to MS66+ 1795 eagles that are CAC-approved are much more appealing than this specific Bass Collection 1795 eagle, in my view.

For a certified MS64 grade early U.S. gold coin, this Bass Collection 1795 eagle is average at best. Greysheet Bid was $500,000 and the CPG retail price estimate was $600,000, which I found to be too high. A strong result for this coin would have been in the range from $500,000 to $575,000. I have been paying attention to 1795 eagles for a very long time, and the $690,000 result for this coin surprised me.

The $72,000 result for the Bass Collection, PCGS graded AU58+ 1797 Heraldic Eagle ten did not surprise me at all. This is a medium level retail price for this 1797 eagle, or for the holder. It is likely that collectors were seriously bidding.

The $38,400 result for the 1799 Small Obverse Stars eagle in a PCGS AU Details holder relates to a question that I raised in my preview of the Bass I sale. What are the premiums that collectors are willing to pay for representatives of rare die pairings of pre-1840 gold coins?

If it was of a much less scarce die pairing, this 1799 eagle in a PCGS AU Details holder would probably have had a medium retail value of around $15,000. The Heritage catalogue indicates that just seven or eight are known of its die pairing (BD1). The $38,400 result for this coin probably incorporates a substantial premium for a rare die pairing, especially since this coin has very serious problems, which are readily apparent. Results in this sale provide circumstantial evidence that at least three collectors are serious about assembling a set of die pairings of bust eagles.

The Bass Collection, CAC-approved, PCGS graded MS64 1799 Small Obverse Stars eagle realized $264,000. This was an extremely strong price, if bidding was for the date rather than the die pairing (BD5). Though this die pairing is rare, in cases where more than twenty are known of a die pairing and for coins that grade above MS63, leading bidders are usually more interested in the date or major variety than in the rarity of the die pairing. Collectors of pre-1840 gold coins by die pairing do not usually bid aggressively on coins that are certified as grading above MS63, though there have been exceptions to this rule.

For a CAC-approved MS64 grade 1799 Small Obverse Stars eagle as a date, Greysheet-CAC Bid was $177,500 before the auction and then increased to $180,000 on October 1, 2022, two days after the Bass I sale. From August 30, 2021, well after the boom in rare date gold began, until February 21, 2022, Greysheet-CAC Bid for one of these was $117,300. On February 22, 2022, it was increased to $175,000, quite a jump.

The CPG-CAC estimate of a medium retail price was raised to $216,000 on February 22, 2022. The CPG-CAC estimate was thus $150,000 or less a year ago; I do not remember exactly. In my view the $216,000 CPG estimate is a little high and the $264,000 result on September 29 is far above a medium retail level for the date and certified grade. If the top bidder was focusing on the die pairing, however, then an interpretation of the price realized would be more complicated.

In some cases, without information about the leading bidders, it is hard to tell whether an auction result is a very strong price for the date or is indicative of a large premium for a rare die pairing. This point relates to a Bass Collection, PCGS graded MS62 1799 Large Obverse Stars eagle, which realized $63,000. It is a very realistic possibility that either the buyer or the underbidder was focusing on the die pairing. Fewer than twenty of this coin’s die pairing have been positively identified. The buyer, however, could have been a collector who does not care about the die pairing, and just intensely demanded an uncirculated 1799 eagle during this auction.

As for the PCGS graded MS65+ 1801 eagle, without a CAC sticker, the $288,000 result was not strong. Although I am now analyzing auction results in the context of current market levels, two past auction results are especially relevant to the $288,000 result for this 1801 ten.

On April 23, 2015, Heritage auctioned a PCGS graded MS65 (not 65+) 1801 eagle, without a CAC sticker, for $258,500. At the time, that price was considered to be around the wholesale-retail border. There is a very good chance that a PCGS graded MS65+ 1801 would then have brought more than $258,500 in that same auction, imaginatively.

For most rare gold coins, market levels were much higher in 2021 and 2022 than they were in April 2015. Would it have made sense to figure that this Bass 1801 eagle was likely to sell for far much more than $288,000 on September 29, 2022?

On January 13, 2022, the Stickney-Pogue-Simpson 1801 eagle realized $432,000. The Stickney-Pogue-Simpson 1801 was PCGS graded MS64+ and has a CAC sticker. Although it was CAC approved, it is not typical for a PCGS graded MS64+ coin to realize far more, $432,000, than a PCGS graded MS65 + coin, $288,000, which was struck from the same pair of dies.

Yes, it is true that the $432,000 result in January 2022 was extremely strong. Even so, that result provides evidence that the $288,000 result for the presently discussed Bass Collection 1801 is not strong at all. Yes, I found the Stickney-Pogue-Simpson coin to be of higher quality and be more desirable overall than the presently discussed Bass Collection 1801 eagle. My opinions about the coins themselves are beside the point that the holders (coins accompanied by particular certifications) have value and $288,000 was not a strong price for an 1801 eagle in a PCGS holder with a MS65+ grade assignment.

The $96,000 result for the Bass Collection, PCGS graded MS63 1803 Small Reverse Stars eagle was very strong. The Greysheet Bid value of $61,600 and the CPG medium retail estimate of $73,900 are acceptably accurate, from my perspective. Even a price realized $78,500 would be in the middle area of the retail range.

The $96,000 result is substantially higher than a medium-retail price. I examined this coin and I did not perceive a reason for it to be worth a premium over other PCGS or NGC graded MS63 1803 Small Reverse Stars eagles. The PCGS population for these in MS63 is sixteen and one has been PCGS graded MS63+.

The Bass Collection, Proof 1804 eagle is discussed in my pre-sale article. The value of these may be interpreted as being connected to diplomatic Proof sets of the mid 1830s and to Class One 1804 dollars. Alternatively, the value of these may be understood in the framework of values of pre-1840 Proof gold coins. The three known Proof 1804 eagles are the only Proof Draped Bust eagles that have been available in more than a century, and are the only pre-1838 Proof eagles known in the present. In contrast, Proof half eagles and quarter eagles from the 1820s and early 1830s are around.

Given the differences in quality, the $2.28 million result for the Bass Collection, Proof 1804 eagle in September 2022 is even stronger than the $5.28 million result for the Simpson Collection, Proof 1804 eagle in January 2021, which was startling. It was not known in January 2021, however, that a boom in rare date gold was just beginning and has been sustained ever since.

Also, it was not clear in January 2021 that Proof gold coins from the 1820s and 1830s had markedly increased or would soon rise tremendously in value. These will be analyzed in the future.

Highlights from the Bass Core Collection

Copyright ©2022 Greg Reynolds

Images are shown courtesy of Heritage Auctions (www.ha.com).

More than 750 of Greg’s articles about coins and related items have appeared in ten different publications. Reynolds has closely examined a tremendous number of rare or conditionally rare, vintage U.S., British and Latin American coins. Furthermore, he has attended dozens of major coin auctions. Greg is available for private consultations and analyses, especially about rarities and auctions: Insightful10@gmail.com

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to The Greysheet for the industry's most respected pricing and to read more articles just like this.

Source: Greg Reynolds

Please sign in or register to leave a comment.

Your identity will be restricted to first name/last initial, or a user ID you create.

Comment

Comments