Silver Running Up To First For Many Collectors & Investors

In the Olympics, winning a silver medal usually means coming in second behind the first-place gold medal winner. In the world of insurance, a silver plan probably covers the doctor and prescriptions you want but comes with a big ol’ four-figure deductible to boot. Yet, in the numismatic world, silver doesn’t play second fiddle to gold – or anything else.

Editor’s Note: This article was previously published in COINage magazine

In the Olympics, winning a silver medal usually means coming in second behind the first-place gold medal winner. In the world of insurance, a silver plan probably covers the doctor and prescriptions you want but comes with a big ol’ four-figure deductible to boot. Yet, in the numismatic world, silver doesn’t play second fiddle to gold – or anything else.

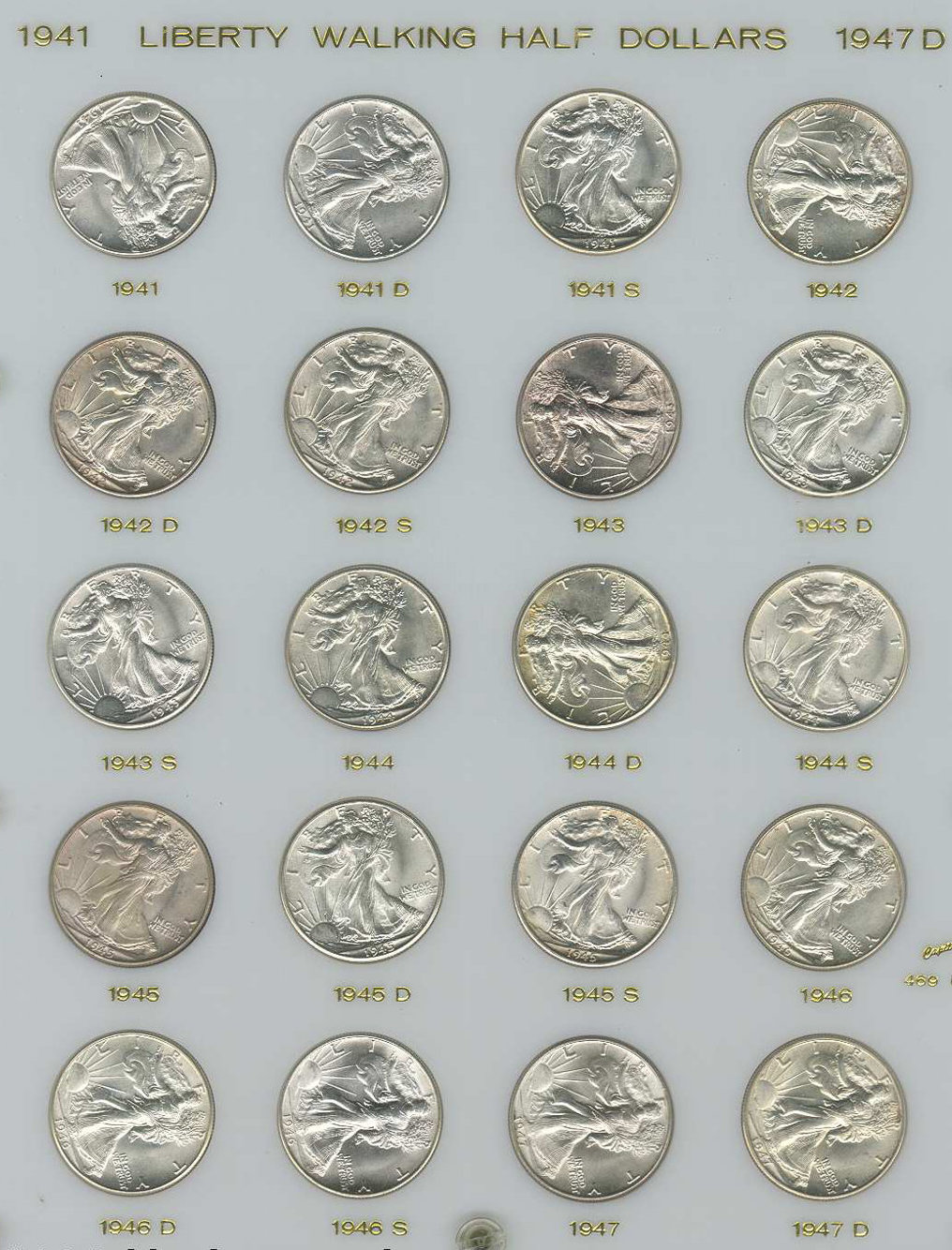

Silver coinage is among the most popular in virtually every segment of the marketplace, from collectors who seek budget-friendly modern coins to advanced specialists pursuing early American type coins. One of the most popular United States coins of all time is the Morgan dollar, the iconic 90% silver Liberty head coin designed by George T. Morgan and produced from 1878 through 1921. And the coin vaunted as one of America’s most beautiful is the Walking Liberty half dollar, a timeless 90% silver series designed by Adolph A. Weinman and struck from 1916 through 1947. Beginning in 1986, Weinman’s Walking Liberty design was replicated on the American Silver Eagle, which launched in 1986 and soon became one of the most widely sought silver bullion coins in the world.

Some of the first coins ever struck in the United States were half dismes, the forerunner of the five-cent denomination that many consider the first coins ever struck under the authority of the Mint Act of 1792. Folklore suggests the silver for the production of these coins was melted down from George and Martha Washington’s personal collection of tableware. A slew of other silver coins came online over the next few years, including half dollars and silver dollars in 1794 followed by dimes and quarters in 1796.

Sure, silver coins may be popular, artful, historically significant collectibles. But how has silver coinage performed over the long term in the numismatic world and as a bullion commodity? What are some of the secrets of timing your next silver purchase or sell-off? Could silver have a lustrous 2019?

***

Examine the price performance of silver coins over the years, and history will prove that collectible and bullion coins made from the prized white metal have endured a wild roller coaster ride. This is both because of fluctuations in spot metal prices and changing winds in the numismatic market. Across the board, silver coins have increased handsomely in value since the early 1960s, when bullion prices reached above $1.29 an ounce, making it profitable to melt circulating 90% silver coins such as dimes, quarters, and half dollars. This caused widespread hoarding of silver coins across the country, leading to a phaseout of 90% silver coinage in 1965.

Around that time, in 1963, Coin Dealer Newsletter, now known as Monthly Greysheet, began tracking the wholesale coin prices paid by coin dealers. Thanks to this historical pricing data, we can look back today and see how silver coin prices have changed over the years. In June 1963, when the first issue of Greysheet was published, silver was $1.30 per ounce, equating to an inflation-adjusted amount of about $10.69 in today’s dollars. At that time, rolls of contemporary 90% silver dimes, quarter, and half dollars – popular among numismatic speculators at the time – were red hot.

Uncirculated 50-piece rolls of 1949-S and 1950-S Roosevelt dimes, considerably tough among the late dates then, commanded $250 and $225, respectively. Among the tougher Washington quarters were the 1946-S and 1953, which realized $59 and $85 apiece in dealer-to-dealer trades. Half dollars were also sizzling, with rolls of 1949 halves taking as much as $170 in wholesale trading.

Had a young investor in 1963 purchased a bevy of these scarce-date rolls and held on to them over the course of time, he or she could have found themselves becoming more financially well off with their investment. Consider that, as of press time, silver trades for around $15.25 per ounce. Adjusted for inflation from 1963, that hypothetical silver investor is already ahead by about $4 per ounce. Not bad. But here’s the rub: rolls of contemporary silver coinage have lost numismatic value over the years, when adjusted for inflation.

Those rolls of 1949-S and 1950-S dimes now trade for around $1,850 and $1,300. The rolls of 1946-S and 1953 quarters? Those now trade for about $320 and $350. The 1949 halves now fetch about $625. All told, these modern-day prices represent inflation-adjusted losses of approximately 10% to 70%. With numismatic demand for uncirculated rolls nowhere nearly as strong as it was decades ago and silver only marginally better today than it was 55 years ago, would the best opportunity for this now-elderly investor to have been selling those rolls years back, when prices were stronger than today?

Looking back over the previous four decades, silver has enjoyed at least two significant bull markets in the last four decades. Once during the period 1979-81 and again in 2010-13. During both periods, silver briefly flirted with nominal values of nearly $50 per ounce. The peak of the first run, when prices crested to about $49.50 in January 1980, is equivalent in today’s dollars to approximately $115 – an astronomical amount by any measure. Meanwhile, the more recent silver run saw relatively lower inflation-adjusted levels of about $54. Even in June 2011, when silver reached its second all-time peak, the 1980 silver prices were still the highest ever when accounting for the impacts of inflation.

So, what were the intrinsic values of those 90% silver dime, quarter, and half dollar rolls worth back in 1980 and 2011? Assuming a silver price of $50 per ounce, a roll of 90% silver halves contains about $723 in silver, quarters $362, and dimes $145. Of course, those nominal values wouldn’t be any different in 1980 than they were in 2011, assuming the price of silver is the same $50.

Interestingly, much of the coin market was also strong around 1980, when silver prices were booming and bullion speculators were also dipping their toes into numismatic waters. According to Greysheet data, those rolls of 1949-S and 1950-S dimes were trading for about $2,200 and $1,100, respectively, in 1980. These figures trend well past inflationary increases of the 1960s and ‘70s, representing a profit of about 300% for the 1949-S roll and 175% for the 1950-S roll. Meanwhile, the 1946-S and 1953 Washington quarter rolls listed in 1980 for $330 and $310, allowing that investor to pick up handsome inflation-adjusted profits in the early ‘80s of around 50% for the roll of 1946-S quarters and 27% for the 1953 roll. Not too shabby! As for that roll of 1949 Franklins? Listed for $1,500 by Greysheet in 1980, it was yet another winner back then, essentially tripling in value against inflation and rewarding that investor with a tidy $1,040 profit.

As silver prices tumbled throughout the later 1980s and into the ‘90s, so, too, did roll prices also edge downward over time. We can only hope this nameless but prudent investor took his or her earnings from selling those rolls of silver coins in 1980 or ‘81 and immediately invested it in stock shares from digital technology firms IBM or Apple, the latter of which went public on December 12, 1980.

***

The above scenario paints the picture of what can happen when one liquidates their silver numismatic at the right time. Yes, 1980 was a very good time to sell certain silver coins and other numismatic items if they had been bought several years earlier. But 1980 was also a horrible time to buy silver because in a direct dollar-for-dollar comparison basis, even during the 2011 bull market that was to come years later, the white precious metal never reached, let alone eclipsed, its inflation-adjusted high from three decades earlier. Does this mean silver is not a good investment? Not in the least!

First, the most obvious point: who’s to say silver won’t yet again rally to another all-time high? Investors who have theoretically held silver since 1980 and wish to make a profit will need to wait until prices break the three-figure threshold, but those who are considering an investment in silver today are living in a time when the precious metal is trading at multi-year lows. Again, with silver at around $14.50 per ounce, the precious metal is trading for far less than it did during the first half of this decade, when nominal prices were $20 to $30 per ounce or even higher.

Silver has another good thing going for it: like gold, it is an excellent hedge against inflation. While prices are sure to fluctuate with the ebbs and flows of the economy, it nevertheless holds its own well in markets where consumer prices are spiraling upward. There’s perhaps no better example of this than the 1979-81 market, a period of “stagflation” marked by soaring interest rates, double-digit inflation, and increasing unemployment figures – a triple threat that made times tough for many, if not most, Americans. Yet silver held strong, breaking all-time price records and proving an outstanding performer for those who invested prior to the market peak in late January 1980.

Some will point to the silver picture of that period and suggest the reason behind silver’s white-hot market in 1979 and early 1980 had little to do with inflationary economic conditions and everything to do with Texas billionaire siblings William Herbert and Nelson Bunker Hunt. These infamous brothers inherited billions in oil money and sank much of it into silver on the hopes that the spiraling inflation of the 1970s would put pressure on silver prices, turning massive profits for them. The Hunts snapped up billions in silver, cornering the market on the white metal and squeezing available supplies. Yes, the Hunts’ bullion buyout did significantly help inflate the price of silver. But other commodities, including other precious metals, also dramatically increased in price during the inflation-fraught era of the late 1970s and early ‘80s.

During that same period, gold saw a four-fold increase over a period of just a few years to cross the $800 mark in early 1980. Meanwhile, palladium and platinum swelled to then-record prices of nearly $350 for the former and more than $1,000 for the latter.

No bullion investor who cares about the overall welfare of the American economy should wish to see a repeat of those tough times with the mere hopes of seeing an uptick in bullion portfolio profits. But the unfortunate situation for everyone is that our nation may just be in for more tough times down the road.

***

The year 2019 may not be a very good time for many Americans. Interest rates are rising again. The stock market gave many investors a few more gray hairs toward the end of 2018, mainly due to the increasingly tense situations between the United States and some of its biggest trading partners, including China. The tariff war between the US and China may eventually spur some increases US manufacturing, but will those potential new jobs offset massive layoff by American companies that suddenly are paying much more Chinese-made goods that can’t be or aren’t sourced in the US?

The above scenario doesn’t account for other economically negative situations that could unfold in 2019, including sociopolitical mayhem in the US or abroad, terrorist attacks, climate-related troubles, and other impacts that can have deleterious effects on the American or world economy. And what about matters that directly effect bullion metals? Most notable of these are issues relating to the mining or refining of precious metals. Don’t forget, silver is essential in industrial manufacturing and production. So, mining shortfalls and backlogs in refining large amounts of silver during periods of high demand are just two of many potential scenarios in which the bullion market itself experiences extenuating pressures capable of rendering silver supplies scarce and thus increasing metal prices.

In any and all of these cases, bullion metals could handily enjoy significant and enduring increases in value. Does this send silver off to heights of $50 or $100? It’s hard to say. But among a few things to remember is that silver prices are historically tied to gold prices, and bullion levels on the whole often respond to vibrations in other major commodities markets, such as oil. What’s more, bullion prices typically have an inverse reaction to the strength of the US dollar (the value of the US dollar as compared to other major world currencies). In other words, bullion prices tend to languish or drop as the dollar strengthens on the international market. As goes most pricing-related phenomena in the bullion arena, this is not a hard-and-fast rule. However, it is an anecdotal observation with plenty of historic merit.

Over the past few years, silver has made some bold moves. For the first time since August 2010, silver fell below $20 an ounce during the fall of 2014 and has spent most of the past four years hovering between $16 and $18. Investors were excited by a bullish push above the $20 mark in July 2016, but the bears have twice prevailed in the last few years, briefly pulling silver below $15 in late 2015 and again for a sustained period during the summer and fall of 2018. Is it a good time to buy or sell? The crystal ball looks cloudy.

***

For all the talk about silver coinage as a bullion investment, there’s this concept: silver coins as numismatic collectibles. While the buying and selling of silver coins can make or break fortunes for investors, there are many folks who pursue silver coinage with the aim of building sets and mere tertiary aspirations of actually making any profit from this.

Yes, silver numismatic coinage has increased in value over the years. In fact, in looking back through Greysheet data, it can be seen that virtually all classic US coin series have seen some long-term increases in value over the period of years or decades. The major exceptions to this would be found among classic US commemorative coins and some generic (common-date) Gem Uncirculated 20th-century silver types such as Morgan dollars; these series saw massive runups in value during the late 1980s when deep-pocketed speculators and some Wall Street investors embraced MS-grade certified coinage as a portfolio player. Prices crashed in late 1989 and remained suppressed into the ‘90s. Today many of the coins that figured into that feverish market, namely classic commems and many 20th-century silver halves and dollar coins, have fallen to levels representing mere fractions of their late-1980s highs.

Of course, historically low prices represent an opportunity for enthusiasts who wish to build sets of these coins. Greysheet data show the entire collection of classic silver commemoratives, struck from 1892 through 1954, can be acquired in mid-uncirculated grades for as little as 20% of their 1989 prices, and maybe even lower. Meanwhile, some Morgan dollar issues can be bought in the MS-65 range for a fraction of their respective 1989 prices. Consider, for example, the 1878 8 Tail Feathers, 1887-O, and 1921-S. These three pieces were listed at MS-65 in the May 26, 1989 issue of Greysheet with bid prices of $4,000, $11,600, and $4,625. Today, these three Morgans trade in MS-65 for $925, $1,400, and $650. These figures represent their nominal prices; surely, factoring in the effects of inflation since 1989 helps to make these particular Morgan dollars even more alluring to bargain hunters.

And then there is something else collectors should remember: “common-date” silver coinage may not really be as common as it once was. The silver booms of the past resulted in tens of millions of generic 35% silver war nickels, 40% silver quarters, halves, and dollars, and 90% silver coins meeting their demise in the smelting pot. Presumably, future silver runs will also spell a fiery end for millions upon millions of other generic silver coins. This does not necessarily mean common coins like circulated 1940s Mercury dimes, worn 1950s Washington quarters, or uncirculated 1964 Kennedy half dollars will become rare in our lifetimes. However, some lower-mintage issues that presently trade at or near their bullion melt values may become noticeably more challenging to locate down the pike.

***

There’s always a silver lining when it comes to silver. When prices are down, silver affords investors and collectors an excellent chance to buy with decent hopes of realizing profits at a later date. Conversely, when metal prices are up, those who hold silver benefit from those increasing prices, as does the hobby, which invariably sees an influx of foot traffic when bullion prices go up. Silver may be among the whitest of metals, but in the bullion and numismatic marketplaces it’s one of the most colorful, providing endless opportunities for profit seekers and coin enthusiasts alike to build winning portfolios and beautiful collections.

Is silver a guaranteed investment? No. But it can provide its owner with a solid insurance policy against economic travails and help soften the blow of a rough stock market, choppy real estate waters, or sky-high inflation. The silver you buy today may or may not be worth more when you decide to sell it months, years, or decades from now. But in a world where anything goes, silver remains a top investment choice among investors who wish to diversify their portfolios with bullion or simply stack some in their personal vaults for that proverbial rainy day.

Trade silver coins in favorable conditions and you’re sure to reap financial gain. But if you buy the best-quality examples of what you like, purchasing silver coins that speak to your numismatic soul, then no matter where the market ends up you’ll enjoy the real rewards. Realize a profit in the long run? That’s just icing on the cake. •••

Download the Greysheet app for access to pricing, news, events and your subscriptions.

Subscribe Now.

Subscribe to CPG© Coin & Currency Market Review for the industry's most respected pricing and to read more articles just like this.